Following the compliance notices of the Financial Intelligence Unit (FIU) of the Indian Ministry of Finance to nine foreign crypto exchanges, the OKX cryptocurrency exchange has ceased operations in India.

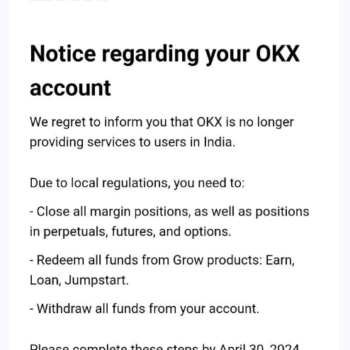

On March 21, OKX notified its Indian clientele, requesting that they terminate their accounts and withdraw funds before April 30. The cryptocurrency exchange attributed its decision primarily to regulatory obstacles in the local area.

Within two weeks of receiving the notice, the FIU requested that the Ministry of Electronics and Information Technology disable the websites of the notified cryptocurrency exchanges.

Following a January ban by authorities on its website and application, OKX reinstated a registration process that included stringent Know Your Customer verifications; nevertheless, the exchange’s notice to users indicates it will cease operations in India.

Despite being a flourishing market, India remains a challenging domain for foreign cryptocurrency exchanges due to the absence of clear regulatory guidelines and stringent government actions.

Despite nearly four years of ongoing discussions concerning a regulatory framework, it seems that the Indian government has no intention of recognizing or subjecting the nascent cryptocurrency market to legal supervision.

A substantial 30% tax on crypto income, with no provision to mitigate losses, and a 1% tax deducted at source (TDS) on each crypto transaction have compelled several established players to relocate their operations outside of India despite the absence of a timeline for the implementation of formal crypto regulations.

The Indian Finance Minister stated in a recent interview that cryptocurrencies cannot be treated similarly to fiat currencies; thus, the government has yet to establish a transparent regulatory framework.

However, this has been the standard response from governments around the world and is unrelated to regulating the cryptocurrency market, as market participants are not requesting that cryptocurrencies be accorded the same weight as domestic fiat currencies; instead, they are asking for more explicit regulations comparable to those of the traditional stock market.