According to Glassnode, Bitcoin on-chain analysis shows that more short-term holders are losing money, and they are statistically more likely to sell.

Glassnode, a blockchain analytics company, has painted a bleak picture for Bitcoin, claiming that on-chain analysis indicate that further selling pressure is on the way.

Glassnode, an on-chain metrics provider, warned in its weekly analytics report on Feb 21 that Bitcoin bulls “facing a variety of headwinds,” pointing to increasingly pessimistic network data.

The present risk-off mentality for crypto assets, according to the researchers, is due to widespread weakness in mainstream markets as well as broader geopolitical worries.

“Weakness in both Bitcoin, and traditional markets, reflects the persistent risk and uncertainty associated with Fed rate hikes expected in March, fears of conflict in Ukraine, as well as growing civil unrest in Canada and elsewhere.”

“The probability of a more persistent bear market can also be predicted to increase as the decline intensifies,” it added.

Bitcoin is currently down 47% from its all-time high in November and has been on a downtrend for the past 15 weeks.

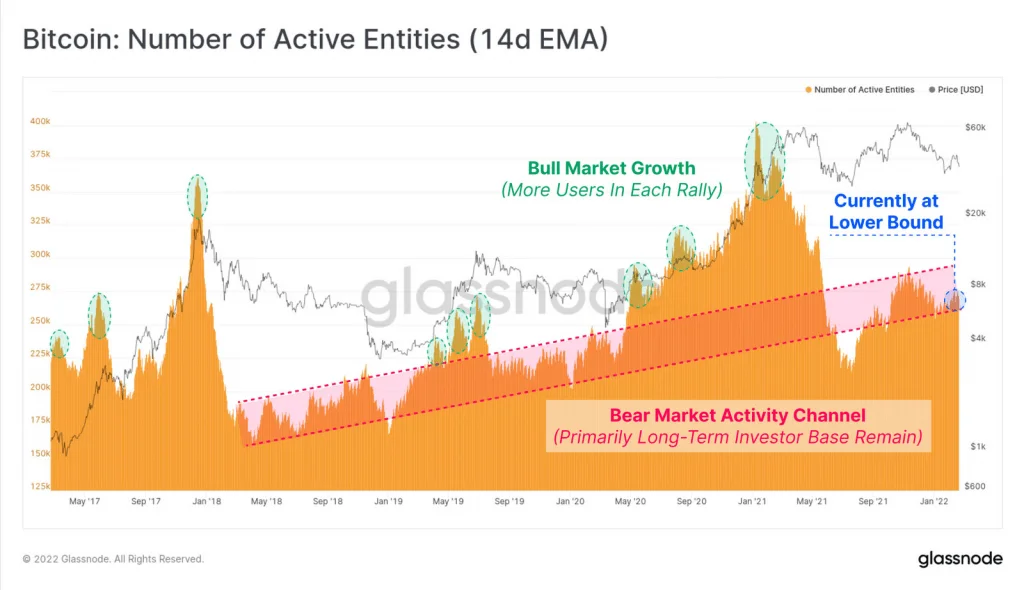

One of the telltale signs of a negative Bitcoin market is a lack of activity according to the On-chain analysis.

The number of active addresses or entities is currently near the lower bound of the bear market channel, which represents on-chain activity during sideways or downtrending markets, indicating a drop in demand and interest.

According to Glassnode, roughly 219,000 addresses have been emptied in the last month, indicating that the network may be entering a phase of user outflows.

It computed a short-term holder realized price on an aggregate cost base of $47,200, implying that the average loss for those still holding the asset is roughly 22% at current levels.

“The longer that investors are underwater on their position, and the further they fall into an unrealized loss, the more likely those held coins will be spent and sold.”

There were various more measurements of long and short-term on-chain positions, all of which led to the conclusion that 4.7 million BTC are currently underwater.

More than half, or 54.5 percent, is owned by short-term investors (less than 155 days), who are “statistically more inclined to spend it,” according to the report.

Crypto Over the last two days, Twitter has been saturated with gloomy emotion, and the Bitcoin Fear and Greed Index is sitting at 20 — “severe fear.”

BTC prices had dropped 6% in the last 24 hours to $36,738 at the time of writing, according to CoinGecko.

Bitcoin is now trading at a price that is very close to its 2022 low, which was just over $35,000 on January 23.

On the plus side, We reported on February 19 that the idle Bitcoin supply is approaching record levels, with over 60% of BTC remaining unspent for at least a year.

Many people who acquired BTC in 2017 and 2018 are still hodling, according to 3AC co-founder Zhu Su, who added, “Anecdotally many of these ppl are keeping humble this time and buying every month regardless of what else is occurring.”