According to a new report, only a few nations have initiated market regulations despite the exponential growth of stablecoins, or cryptocurrencies such as Tether and USDC, which have surpassed all previous records in recent months.

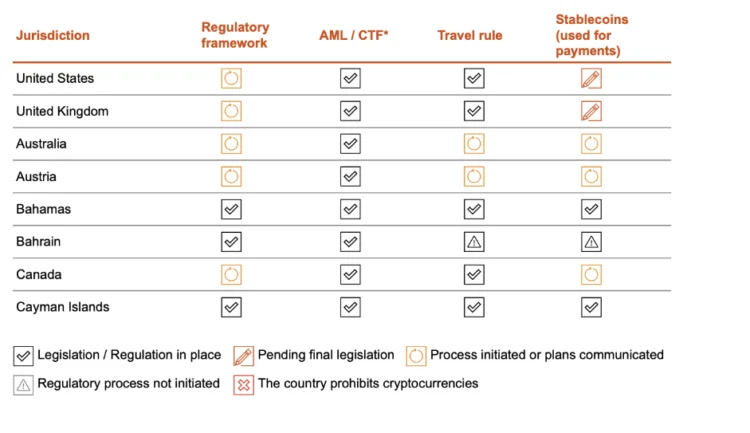

As of December 19, 2023, only six nations had legislation or regulation regarding stablecoins, according to the PwC Global Crypto Regulation Report 2023.

These nations are Switzerland, The Bahamas, The Cayman Islands, Gibraltar, Japan, and Mauritius, according to an analysis and regulatory assessment conducted by PwC.

The report notes that the nations that implemented stablecoin legislation have also ensured compliance with all the other examined regulations, such as the Financial Action Task Force’s Travel Rule, a crypto regulatory framework, and anti-money laundering (AML) regulations.

The professional services firm evaluated the state of crypto regulations in 35 countries, including the United States and the United Kingdom, in its most recent report on crypto code.

PwC’s analysis indicates that nations such as the United States and the United Kingdom still need to establish a regulatory framework for cryptocurrencies or finalize legislation about stablecoins.

According to the report, fourteen jurisdictions, or forty percent of the analyzed nations, have yet to implement stablecoin regulations. Denmark, Estonia, France, Germany, Taiwan, and Turkey are some such nations.

25% of the jurisdictions under review, such as Italy and Hong Kong, have initiated or communicated plans for stablecoin regulation. In contrast, only 9% of nations, including the United Arab Emirates, are finalizing stablecoin laws.

Three nations, including the People’s Republic of China, Qatar, and Saudi Arabia, have prohibited the use of cryptocurrencies, according to the report by PwC.

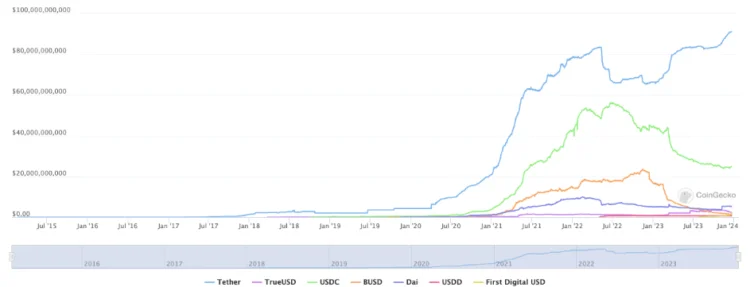

Tether, the most actively traded asset daily, is a stablecoin that is an essential component of the cryptocurrency ecosystem. Based on data provided by CoinGecko, the daily trading volumes of Tether surpass those of Bitcoin by 23%, totaling $34 billion.

The value of the stablecoin market increased by billions in 2023 due to Tether and other stablecoins’ meteoric rise. In mid-December 2023, Tether surpassed $90 billion in market capitalization for the first time, amassing 36% growth since January.

As per the findings of CoinGecko, the aggregate market capitalization of stablecoins has ascended to an all-time peak of $131 billion this year.

Some analysts predict that the market for stablecoins will continue to expand. Bitwise’s Ryan Rasmussen said stablecoins enable more transactions than the multinational colossus Visa in 2024.