According to the crypto exchanges, the new buy limitations are meant to “protect crypto investors” and make them “more aware of the hazards”

In order to “protect customers” despite stricter laws, Canadian crypto exchanges Bitbuy and Newton are imposing a 30,000 Canadian dollar yearly “buy limit” for “restricted currencies” for their users living in Ontario.

After working to become registered with the Ontario Securities Commission and the securities regulatory authorities in other Canadian provinces and territories, Newton, a Toronto-based cryptocurrency exchange, revealed the new modifications, saying in a statement on Tuesday:

“These changes are to protect crypto investors, like yourself, and to make sure investors are aware of the risks associated with investing in crypto assets.”

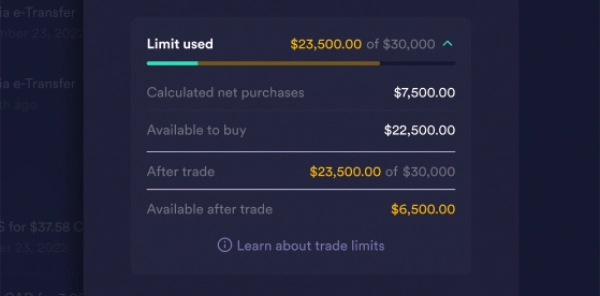

The new regulations would impose an annual 30,000 CAD “net buy limit” on all cryptocurrency coins, with the exception of Bitcoin (BTC), Bitcoin Cash (BCH), Ether (ETH), and Litecoin, for crypto traders domiciled in Ontario using Newton and other Canadian crypto platforms (LTC).

Newton added that the sell amount would be deducted from the limit if a trader purchased a limited coin and later sold it. After the first purchase of restricted coins, the cap is reset once every 12 months.

The buy limits coincide with the cryptocurrency platform’s Wednesday announcement that it has formally registered as a “restricted dealer” in the province of Ontario, making it subject to the rules established by the Ontario Securities Commission (OSC).

The crypto exchanges are required to ask users about their prior experience with and knowledge of investing in cryptocurrencies, as well as their financial situation and risk tolerance. This information must be provided in order for the exchange to continue funding the user’s account and allowing them to trade on the platform.

If a trader’s portfolio experiences a loss level above what they mentioned in the questionnaire they are not comfortable with, the crypto exchange will also notify the trader.

Earlier this year, the Canadian cryptocurrency exchange Bitbuy confirmed the existence of similar purchase restrictions. It added that users in the Canadian provinces of Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island, Northwest Territories, Nunavut, and Yukon are also subject to the same limitations.

Like Newton, Bitbuy asks potential investors to complete a questionnaire to assess whether they are Sophisticated, Eligible, or Retail Investors. However, whereas Eligible Investors have a higher buy limit of 100,000 CAD and Accredited Investors have no purchase limit, Retail Investors are still subject to the 30,000 CAD buy limit.

Newton gave investors a sneak preview of what the new regulations would look like when they go into effect.

Nearly 40% of all Canadians live in the province of Ontario, with Toronto serving as the main metropolitan center.

In Canada, each province and territory has its own securities regulating body, which together make up the Canadian Securities Administrators, according to Newton (CSA).

Canadian regulators are not solely concerned with consumer protection. The Canadian federal government said in April 2021 that it would review its financial sector legislation to enhance the security and stability of digital currencies and establish a central bank digital currency (CBDC).

With over 100,000 users as of February 2021, Newton, which bills itself as “Canada’s trust low-cost crypto trading platform,” is one of the most well-liked exchanges in Canada. Newton was formed in 2018.