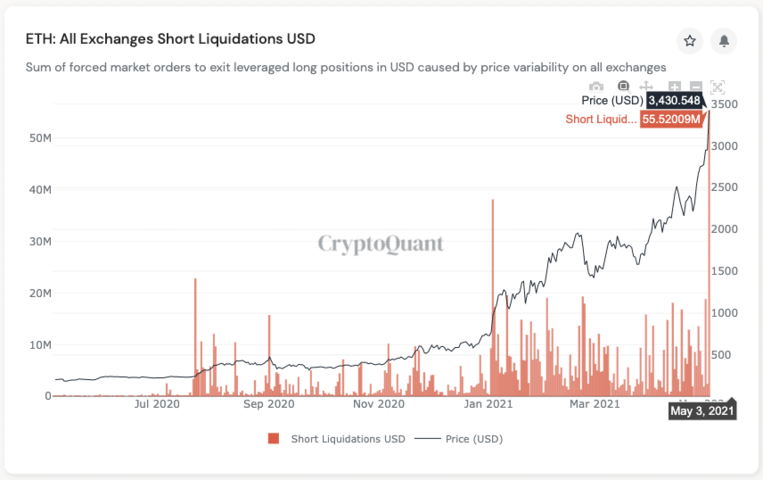

The new Ethereum price pump, which reached a fresh all-time high of $3,450 caused significant losses to bears.

On-chain data shows a new record of short-term winding-ups for all derivatives exchanges in the last day alone worth more than $375 million.

ETH causes Bears Mass Pain

Recent titles with consistent record all-time high have been made at the price of the second largest cryptocurrency. Since the start of the year, its token has risen by about 350 per cent and just increased its bull run as of May.

At the time ETH traded $2,750 but first in the next 48 hours it broke over $3,000. It was not enough to take this turning point down and went up to its new ever peak of more than $3,450 marked hours ago. The cryptocurrency was not content.

The CryptoQuant analytics resource emphasized pain ETH’s most recent price spike. In all derivatives exchanges, the company has said that the amount of brief payments has always risen. In the last 24 hours, liquidations have reached more than $520 million, where most were short positions, according to Bybt.

It should be noted that the data provided by CryptoQuant show only the results of the contract pairs ETH/USD and ETH/USDT, two for the long term.

Bybt shows that liquidations were made throughout the crypto-monetary market after increased volatility for most assets. Over the last 24 hours, the total amount is nearly 1,5 billion dollars, and over 140,000 traders have been liquidated.

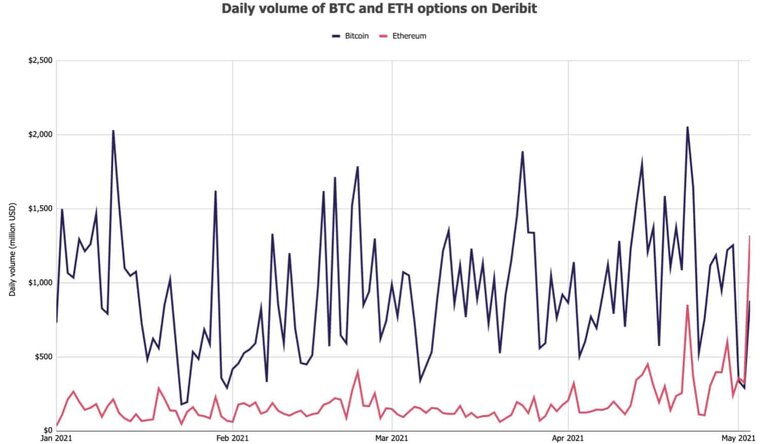

Higher than BTC ETH Deribit Volume

According to additional data from Skew, investors have become more interested in Ethereum trading than Bitcoin, at least on Deribit’s crypto-trading. The volume of trading options of ether (ETH) for the first time exceeded that of BTC.

The cryptocurrency trading platform in Panama City reported the twist on Twitter, but was unbiased in the creation by stating, “we have no opinion.”