In preparation for a Central Bank Digital Currency (CBDC) by the year 2025, the State Bank of Pakistan (SBP) has signed in new laws for Electronic Money Institutions, and non-bank entities offering digital payment instruments.

Central bank digital currencies (CBDCs), which inherit the financial prowess of the technology that fuels cryptocurrencies, are seen by regulators all over the globe as a method to improve fiat capabilities. By establishing new rules to guarantee the establishment of an internal CBDC by 2025, Pakistan added its name to this list.

In order to secure the prompt issue of a CBDC throughout the course of the next three years, the State Bank of Pakistan (SBP) approved new rules for Electronic Money Institutions (EMIs), non-bank businesses that provide digital payment instruments. According to local media outlet Arab News, the World Bank assisted Pakistan in creating the new legislation.

The laws mandate preventative measures against money laundering and terror funding while taking consumer protection and reporting obligations into consideration, in addition to deadline adherence for the CBDC debut.

EMIs will get licenses from the state bank, SBP, for CBDC issuing. Asad Umar, the finance minister, said at the announcement that utilizing EMIs to promote the digital economy would protect financial institutions from cybersecurity risks. Jameel Ahmad, the deputy governor of SBP, wants to use CBDCs to address corruption and inefficiencies brought on by fiat. He stated:

“These landmark regulations are a testament to the SBP’s commitment toward openness, adoption of technology, and digitization of our financial system.”

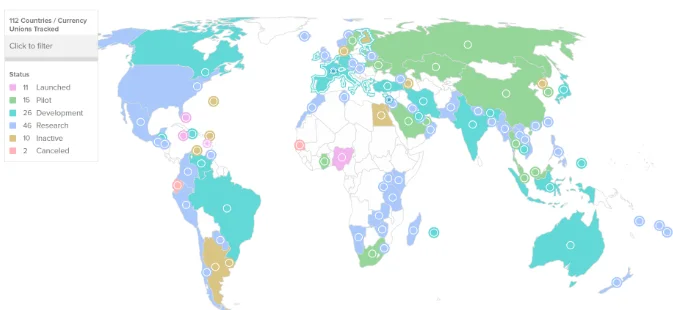

Pakistan has joined the roughly 100 nations that are actively interested in exploring and establishing CBDC activities thanks to the start of a quick regulatory framework.

India, a neighboring nation, has entered the competition to establish a domestic CBDC. The Reserve Bank of India (RBI) unveiled an ambitious proposal on November 22 to start a retail CBDC pilot program by the end of 2022.

According to reports, the retail digital rupee pilot deployment, which would first be tested among 10,000 to 50,000 consumers of participating banks, is now in its last stages of preparation by the Indian central bank, RBI.