PayPal has amended its terms and conditions to include the Crypto Hub service. This feature lets users hold and trade Bitcoin and other cryptocurrencies in their PayPal accounts.

The most recent PayPal terms and conditions outline the requirements crypto users must meet to use the platform for cryptocurrencies.

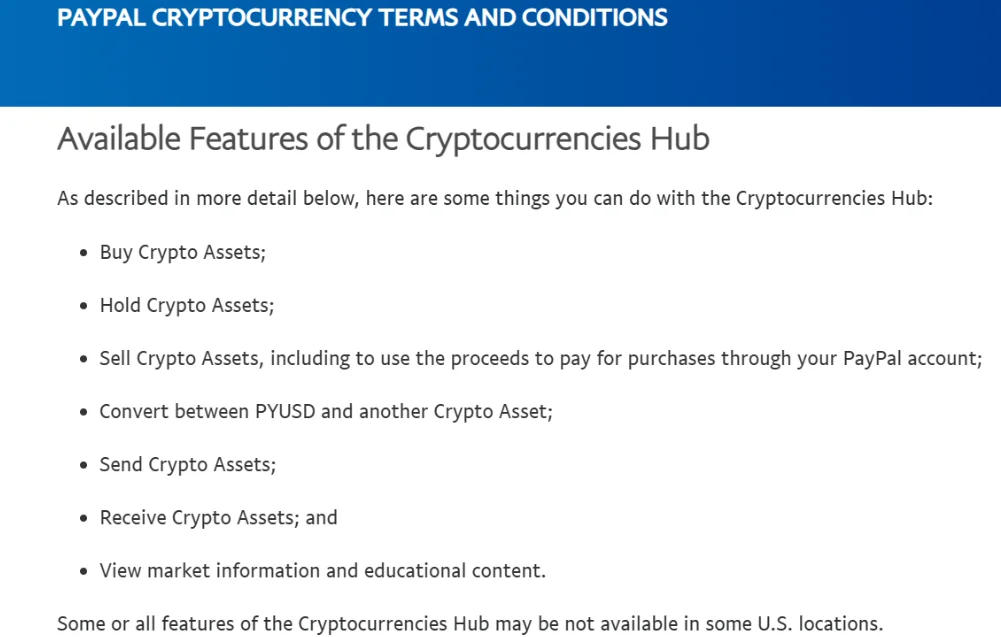

The company claims that the Cryptocurrencies Hub service will facilitate the sale and purchase of cryptocurrencies. In addition, it will enable purchases to be paid for via PayPal with funds retained after the sale of cryptocurrencies.

The Cryptocurrencies Hub will also be essential for converting PYUSD to other cryptocurrencies. PayPal clarified further:

“Any balance in your Cryptocurrencies Hub represents your ownership of the amount of each Crypto Asset shown. You will not hold the digital Crypto Assets themselves in your Crypto Asset balance.”

However, not all PayPal users can access the new feature, as the company will determine individual access. For Cryptocurrencies Hub eligibility, a user must have “a personal PayPal account and a Balance Account in good standing.”

Additionally, PayPal will verify the required identifying information, including the user’s name, physical address, date of birth, and taxpayer identification number:

“You can only use your Cryptocurrencies Hub as part of your Balance Account by accessing it through your personal PayPal account. If you are a Hawaii resident, we will not allow you to establish a Cryptocurrencies Hub at this time.”

Upon release, Cryptocurrencies Hub will be directly attached to the user’s PayPal account and accessible using the existing login credentials.

The inauguration of PayPal USD polarized the cryptocurrency community, as contradictory speculations about its impact on cryptocurrencies dominated the conversation.

The community warns that while many believe PYUSD will expedite Ether’s mainstream adoption, it could also portend trouble for decentralization and individual control of assets.

Several smart contract auditors noted that the PYUSD smart contract contains the “freezefunds” and “wipefrozenfunds” functions, which, according to them, are canonical examples of centralization attack vectors in Solidity contracts.