The Pakistan Banks’ Association (PBA), a collection of 31 traditional banks operating in Pakistan have agreed to the creation of a Know Your Customer (KYC) platform based on blockchain technology.

According to the Daily Times, the PBA inked the project contract on March 2 to create Pakistan’s first national eKYC banking platform based on blockchain.

The State Bank of Pakistan is leading the program, which aims to improve anti-money laundering skills while preventing the financing of terrorism.

International institutions including the Industrial and Commercial Bank of China, Citibank, and Deutsche Bank are among the member banks. Also, the blockchain platform will increase operational effectiveness, mainly with a focus on enhancing the onboarding experience for customers.

Consonance, a blockchain-based eKYC platform that will be used by member institutions to standardize and exchange client data via a decentralized and self-regulated network, is being developed by the Avanza Group. Banks will be able to evaluate both existing and potential consumers thanks to the consent-based sharing of customer information.

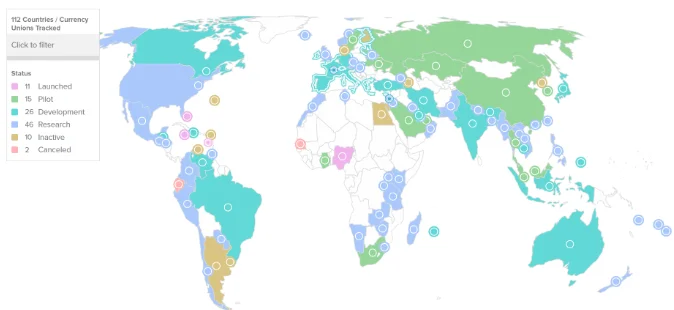

Pakistan recently adopted new regulations to assure the introduction of a CBDC by 2025, joining other nations in the race to build a central bank digital currency (CBDC).

Electronic money institutions will receive licenses from the SPB for issuing CBDC. Deputy Governor of SBP Jameel Ahmad remarked, “These historic laws are a tribute to the SBP’s dedication toward transparency, adoption of technology, and digitization of our financial system.