Peter Brandt has sparked discussions by predicting a potential Bitcoin selloff as it approaches its $100,000 all-time high.

Peter Brandt, a seasoned trader and market specialist, has ignited talks in the wider cryptocurrency market, predicting that there may be a selloff of Bitcoin in the days ahead.

This remark comes at a time when Bitcoin has been hovering close to the $100,000 barrier for the past several days, which is an indication of powerful market confidence in the cryptocurrency.

Peter Brandt Predicts Potential Bitcoin Selloff Ahead

Peter Brandt appears to continue to maintain an optimistic outlook regarding the future trajectory of Bitcoin, despite the fact that he has revealed this cautious sentiment. A number of investors continue to exercise caution in anticipation of a possible selloff as Bitcoin continues to hover near the $100,000 mark, which represents its all-time high.

To put this into perspective, as the price continued to rise, some investors may have decided to book a profit by selling the cryptocurrency. Many industry analysts have hinted at the possibility of a reversal occurring during the bull run.

In this context, the statements that Peter Brandt, a seasoned trader, made recently have captured the attention of several investors. In a recent post on X, Brandt expressed the “possibility” that bulls may sell their Bitcoin holdings once the cryptocurrency approaches the $100,000 milestone, provided it continues to struggle.

He pointed out that the selloff would occur because investors would want to reenter the Bitcoin market at a lower price following it, which would allow them to make more profits. He said that this would assist them in doing so.

On the other hand, he confirmed that although investors are anticipating a “correction,” it is unlikely to occur, thereby highlighting the potential of the cryptocurrency.

The price of the cryptocurrency is not likely to “come down,” according to his prediction, which also included the possibility that it could reach $120,000. It would appear from Brandt’s most recent comments that the expert continues to maintain a positive outlook regarding the trajectory that Bitcoin will take in the future.

In addition, this comes after the expert recently stated that Bitcoin is likely to reach $327 thousand in the not too distant future, which has sparked additional excitement in the market.

Is BTC Selloff Imminent?

An abundance of industry professionals have forecasted that a possible Bitcoin selloff is on the horizon, which has sparked discussions in the market, particularly in light of Peter Brandt’s statement. To put it another way, according to the experts, the profit-booking technique of investors could potentially create a modest slowdown in the rallies that Bitcoin is currently experiencing.

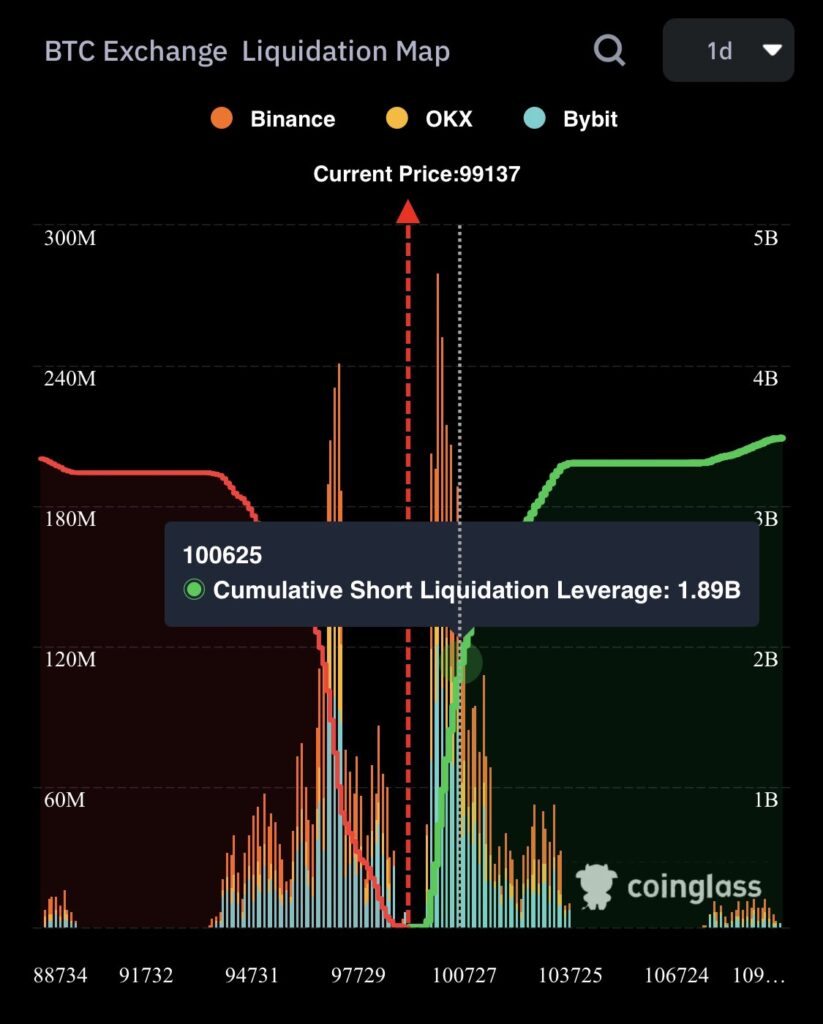

As a point of reference, a well-known cryptocurrency market specialist named Crypto Rover stated in a recent post on X that a “huge sell wall” is waiting for Bitcoin at a target price of $100,000. According to this, investors may decide to liquidate their holdings in the event that Bitcoin reaches this significant milestone in the near future.

Ali Martinez, another expert in the cryptocurrency sector, has expressed a sentiment that is comparable to that of Peter Brandt and Crypto Rover. Martinez has expressed the likelihood of liquidating the flagship cryptocurrency for a total of $1.89 billion if it reaches $100,000, a finding that has sparked additional concerns in the market.

The experts, on the other hand, have maintained their optimism over the long-term trajectory, despite the fact that they are concerned about the selloff, which could result in a minor retreat in the future.

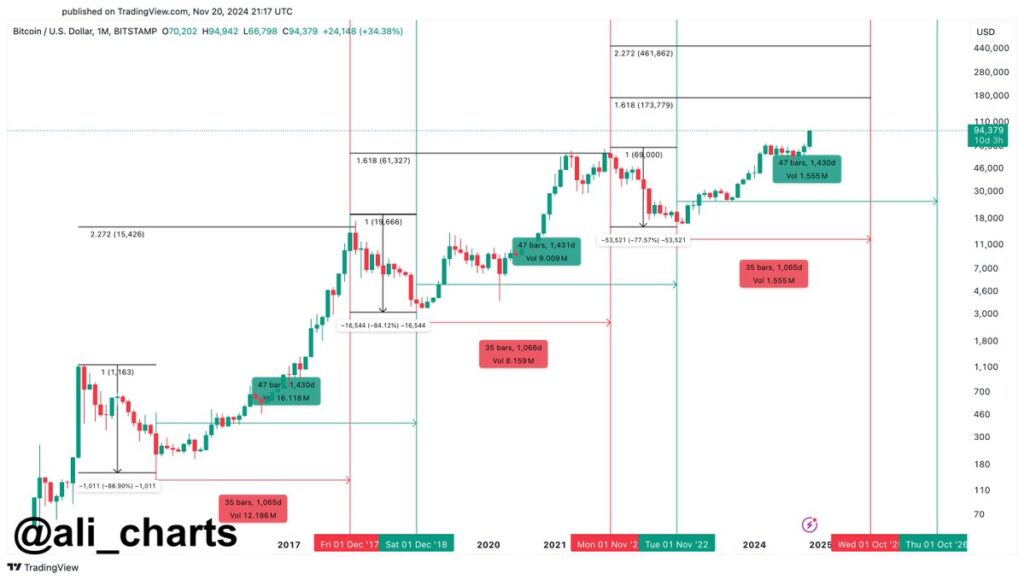

Martinez provided context by mentioning historical trends in a second piece, projecting Bitcoin to reach its peak between $173,000 and $461.00 by October 2025. Today, Bitcoin saw a slight decrease in price, trading at $98,614.

Additionally, the number of Bitcoin transactions dropped by 29% to $68 billion. The cryptocurrency, on the other hand, has lately reached a new all-time high (ATH) of $99,655, which is a 24-hour high.

Nevertheless, data on derivatives provided by CoinGlass revealed that the open interest in Bitcoin Futures suffered a decrease of about two percent over the course of twenty-four hours. This suggests that investors are taking a break in the midst of the recent vigorous advance.