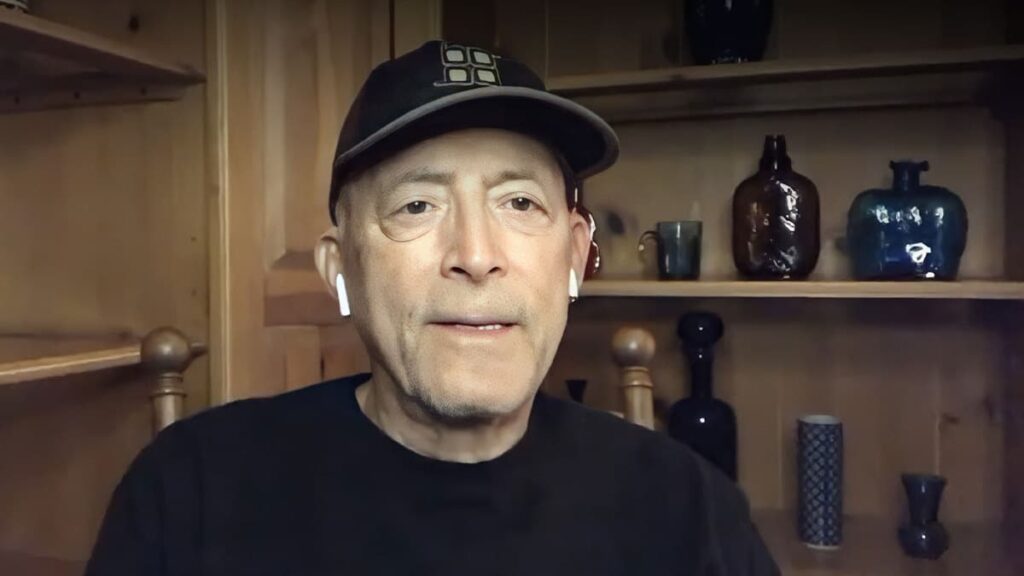

Peter Brandt anticipates the US dollar collapse and views Bitcoin as a viable alternative in the face of increasing fears about financial management.

Peter Brandt, a seasoned trader, has recently expressed his opinions on the potential of Bitcoin as an alternative asset and the abrupt decline in the value of the USD. Additionally, his remarks coincide with an increasing concern regarding the fiscal accountability of the United States government.

Simultaneously, there is a growing trend in the adoption of cryptocurrencies by various individuals, including politicians like the Republican candidate Donald Trump, Vice President Kamala Harris, and business owners like Elon Musk and Mark Cuban.

Peter Brandt anticipates US dollar Collapse

Peter Brandt has foreseen a steep decline in the value of the US dollar. In Brandt’s opinion, the dollar has experienced a decrease in value, and there is concern that this trend may persist. This prediction is consistent with other apprehensions about the future of paper currency in the contemporary economic landscape.

Brandt’s perspective is on the current trend among financial analysts and investors seeking more secure assets.

Brandt has proposed that Bitcoin serves as a repository of value due to the anticipated depreciation of the US dollar. Bitcoin, which has garnered significant attention in recent years and has been enthusiastically adopted by numerous individuals, is perceived by many as a secure refuge in contrast to traditional financial systems.

Bitcoin has also been endorsed by other prominent figures, including Elon Musk and Robert Kiyosaki, who have expressed their belief that the cryptocurrency could be valuable in a world where conventional money is becoming less reliable.

Robert Kiyosaki, Elon Musk’s Perspectives

Elon Musk has recently stirred market speculation with his comments regarding the financial trajectory of the United States. Musk, in agreement with Billy Markus, the co-founder of Dogecoin, stated that the United States is on the brink of bankruptcy due to its inadequate financial management.

In the same vein, Robert Kiyosaki, a Bitcoin advocate, maintained his endorsement of the cryptocurrency, asserting that it would experience substantial growth if Donald Trump were to assume the presidency of the United States.

According to Kiyosaki, Trump’s policies may involve the dollar’s depreciation to boost exports and employment, which could elevate the value of assets like gold, silver, and Bitcoin.

Kamala Harris and the Cryptocurrency Industry

Kamala Harris, the current Democratic presidential candidate, has been observed to interact more frequently with cryptocurrency. According to the reports, Mark Cuban, the owner of the Dallas Mavericks, has been contacted by advisors associated with Harris regarding crypto policy. Cuban regards this as a promising indication that Harris may be amenable to emerging technologies, including artificial intelligence, cryptocurrencies, and government as a service model.

Harris has also been encouraged by the Digital Chamber to use cryptocurrency during the public campaign. The association recommends that the Democratic Party prioritize cryptocurrency and communicate more transparently with significant stakeholders. The crypto industry has already been abuzz with Harris’s campaign, which commenced after President Joe Biden declared his intention to forgo the presidency in the forthcoming election.

However, Tom Emmer, a US Congressman, has recently criticized the US Securities and Exchange Commission (SEC) and its chairman, Gary Gensler, for the potential risks associated with Harris’s candidates for the position of Treasury Secretary. According to Emmer, the stability of the US financial system and the future of cryptocurrency regulation would be at risk if Kamala Harris were to select her as the Treasury Secretary and potentially nominate Gary Gensler or Elizabeth Warren.