Peter Schiff has compared MicroStrategy to gold mining companies in anticipation of the MSTR stock’s highest close since 2020.

Noted economist Peter Schiff recently compared MicroStrategy to gold mining companies as the MSTR stock rallies toward its highest close since March 2020.

Peter Schiff: MicroStrategy Comparable to Gold Stocks Amid MSTR Surge

Schiff remarked that MicroStrategy is similar to gold mining companies, observing that while the software firm “earns nothing and practically produces nothing,” it is valued higher than all gold mining companies except Newmont.

He asked his followers whether they believe MSTR’s market cap will exceed Newmont’s NEM.

MarketWatch data indicates MSTR’s market cap at $43.34 billion, with NEM at $55.12 billion.

As a gold advocate, Schiff views MSTR as the most overvalued stock in the MSCI World Index, even predicting a price drop.

Despite this, MicroStrategy’s stock keeps reaching new highs; it’s up over 6% today, nearing a record high not seen since March 2020.

Today’s surge in MSTR appears connected to Bitcoin’s recent price resurgence, reaching $69,000.

Since the start of the year, MSTR has risen by over 293%, outpacing Bitcoin’s gains.

Michael Saylor Emphasizes MSTR’s Outperformance

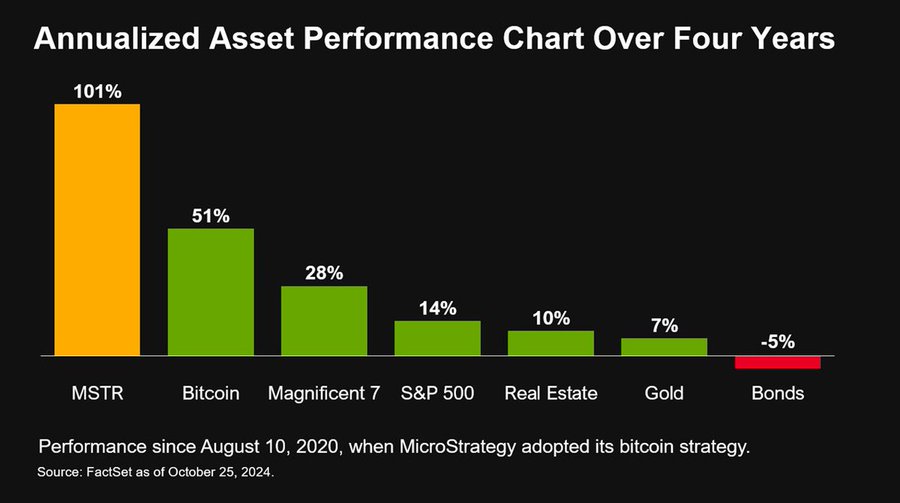

Michael Saylor, MicroStrategy’s co-founder, recently highlighted the company’s stock performance over the past four years.

In an X post, Saylor noted MSTR has yielded greater annualized returns than Bitcoin, the “Magnificent Seven” tech stocks, the S&P 500, and even gold since MicroStrategy adopted its Bitcoin strategy.

Since adopting Bitcoin, MicroStrategy’s stock has posted a 101% annual return over four years, largely due to its exposure to the cryptocurrency.

The company now holds 252,220 BTC, representing 1.2% of Bitcoin’s total supply.

Saylor credited Bitcoin for MicroStrategy’s stock performance, adding the company has no plans to sell its holdings.

Notably, he invited Bitcoin skeptics to short MSTR, calling it the “perfect instrument” for those doubting the cryptocurrency.