Analyst PlanB admits that Bitcoin (BTC) will “probably” miss the end-of-month target in November as BTC/USD is unlikely to reach USD 98,000 in the next five days

Analyst PlanB admits that Bitcoin (BTC) will “probably” miss the end-of-month target in November.

In a November 25th Twitter update, the creator of the “worst-case” price forecast for the end of the month was ready to admit defeat for the first time.

For the first time, the word “probably” is missing from the Bitcoin floor model

Bitcoin is currently trading well below its minimum month-end close in November, with a short position of around $ 40,000.

PlanB now admits that BTC/USD is unlikely to reach USD 98,000 in the next five days.

“Closing the $ 98,000 floor pattern in November will almost certainly be the first failure (after late August, September, and October),” he said on Twitter.

On November 11th, PlanB explained its earlier opinions regarding the exchange concept during an appearance on a podcast series hosted by Saifedean Ammous, author of “The Bitcoin Standard” and “Fiat Standard.”

“If we don’t hit $ 98,000 by the end of November, it will be a first in Bitcoin history for this particular statistic,” he stated.

The sequence correctly predicts monthly closing prices of $47,000, $43,000, and $63,000 for August, September, and October, nearly like letters (or numbers).

Thanks for the annual rise of 200 percent.

Despite breaking with precedent, a decline in the reserve price will have no effect on PlanB’s range of nominal stock movement patterns, he clarified after much consternation regarding the relationship between the two.

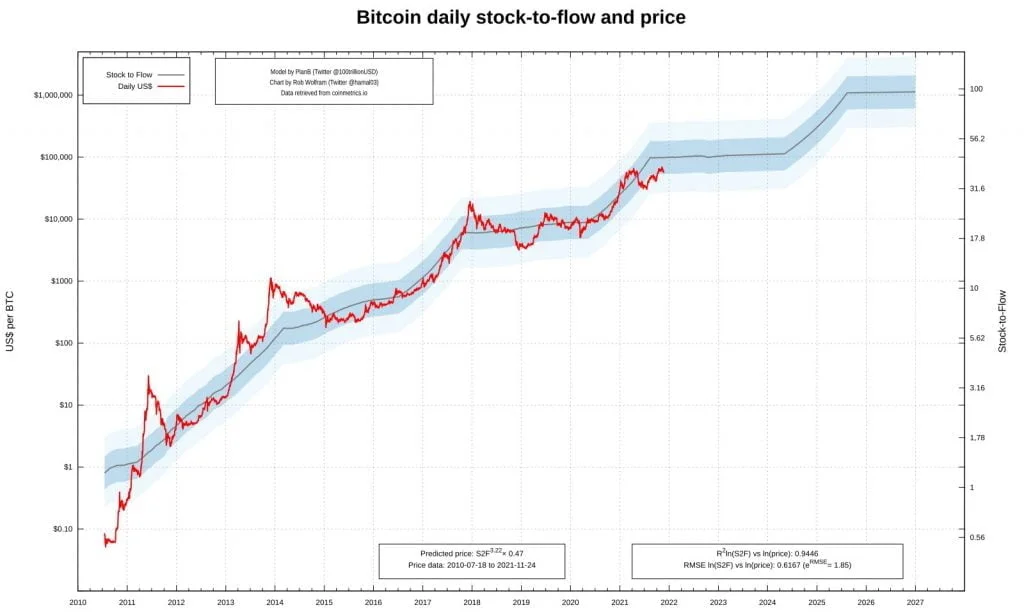

Inventory-to-Flow (S2F) currently claims a BTC/USD average price of $100,000 during this halving cycle, claiming the fourth quarter of 2021 as the correct timeframe for the amount to initially materialize.

Its sister model, the stock-to-flow cross (S2Fx), goes even further, averaging $ 288,000, however, this has since been questioned as BTC underperforms.

PlanB stated in an interview with Ammus that the difference between the market price and the S2F model price does not yet threaten to invalidate.

The pattern uses standard deviation bands to assess progress, and BTC / USD remains within an acceptable range this month.

Meanwhile, as noted by Cointelegraph, a number of other signs remain favorable for the future, with the current price phase considered as a consolidation rather than the start of a deeper drop.

In 2021, BTC/USD will open at $ 29,000, while Hodlers are up more than 210 percent from last year’s Thanksgiving Day.