The Korea Premium Index drives price increases in South Korea’s crypto market, where institutional trading is crucial.

A recent report from Chainalysis shows that South Korea’s cryptocurrency market is experiencing significant growth, largely driven by the rise in the Korea Premium Index.

The report emphasizes that local demand, institutional trading, and specific market dynamics in the country are leading to higher crypto prices on South Korean exchanges compared to global averages.

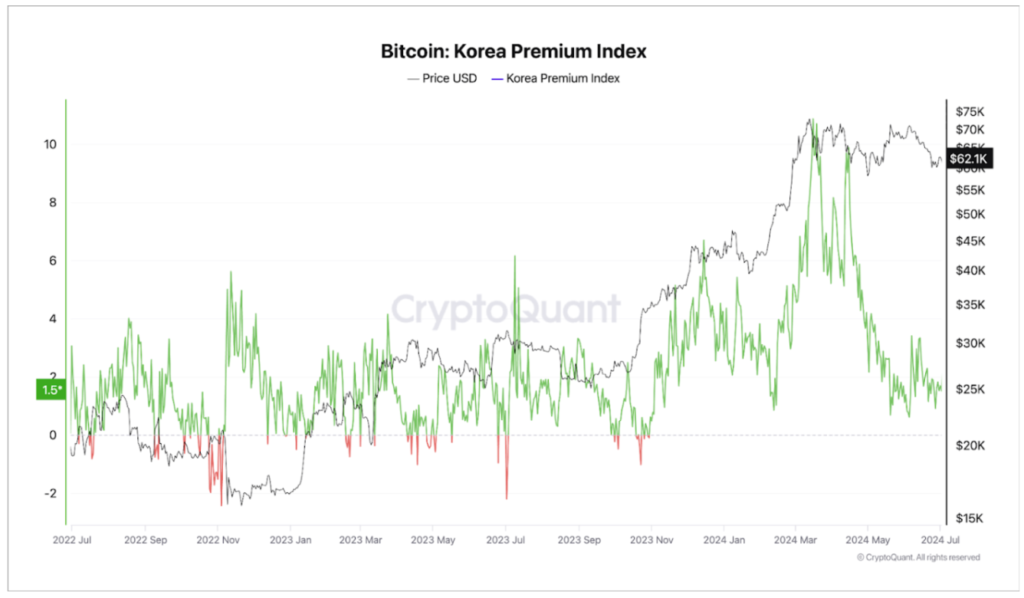

The Korea Premium Index tracks the price differences for cryptocurrencies like Bitcoin, Ether, and altcoins between South Korean exchanges and international markets.

Increasing Local Demand

Chainalysis indicates a noticeable rise in the Korea Premium Index, reflecting how much “South Korean traders are paying above-market prices” for digital assets.

This premium peaks during market uncertainty and volatility, motivating retail and institutional investors to seek profit opportunities.

Additionally, the report notes that “South Koreans often use local exchanges” to manage their funds, with a strong correlation between the premium and the volume of funds moved from local to global exchanges.

Institutional Factors and Effects

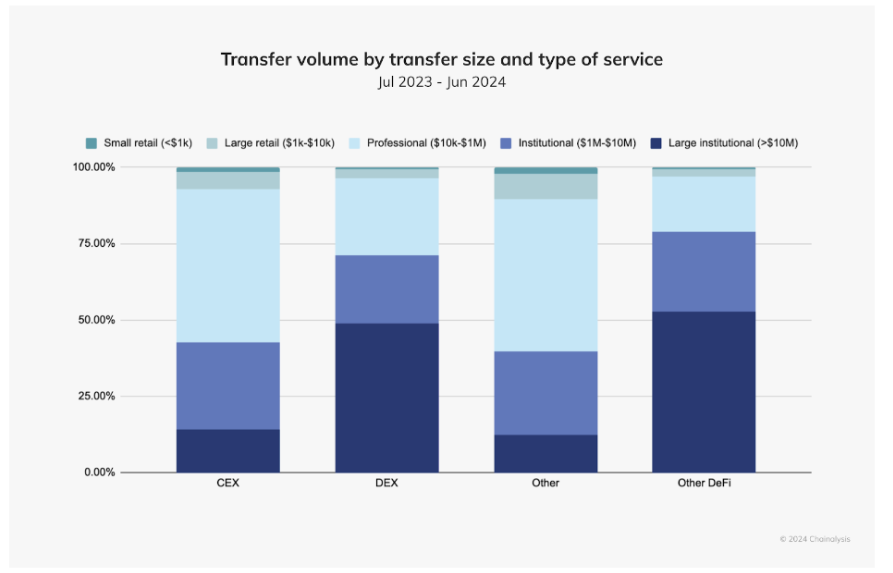

The report also highlights the role of institutional investors, revealing that they are a major contributor to the Korea Premium Index through large-scale transactions.

“Institutional activity is a significant driver of the price discrepancies.”

These institutional players control a large portion of the market’s transaction volume, increasing the premium on local exchanges.

The report explains that institutional investors take advantage of arbitrage opportunities by buying crypto at lower prices on global platforms and selling it at a premium on South Korean exchanges.

Higher Salaries in South Korean Crypto Sector

In a separate report from the Financial Supervisory Service (FSS), it was revealed that employees in the South Korean crypto industry earn more than their counterparts in traditional banks.

Dunamu, the Upbit cryptocurrency exchange operator, paid its employees and executives an average annual salary of 133.73 million South Korean won (approximately $99,500).

This is significantly higher than the average salary of employees at major banks such as KB Kookmin Bank, Hana Bank, Woori Bank, and Shinhan Bank, who earned an average of 116 million won (around $86,700).