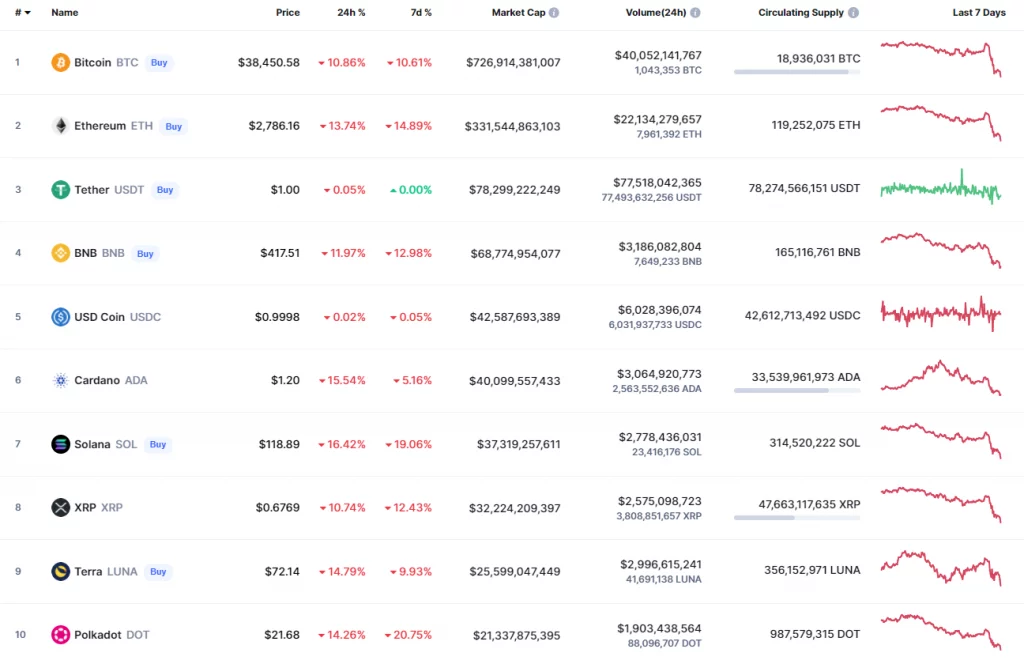

Following the bulls’ failed attempt to seize the initiative, the main coin price have continued to fall. Can one expect any short-term rise soon?

Following the bulls’ failed attempt to seize the initiative, the main coin rates have continued to fall.

ETH/USD

The Ethereum (ETH) price tested the POC line ($3,250) yesterday, as bullish momentum broke through the $3,200 support. Following a daily high of $3,270, a dramatic drop began.

The bearish momentum was so powerful that it broke through $3,000 psychological support and hit a new low of $2,806.

The collapse has now come to a halt, and some recovery is feasible. However, we could expect a continuation of the decrease to around $2,600 in the near future.

At the time of writing, Ethereum was trading at $2,775 per coin.

XRP/USD

The XRP/USD pair recovered above the average price level yesterday morning, reaching a day high of $0.76.

The market crashed in the evening, and by the conclusion of the day, the price of XRP had broken through the $0.70 support level. A minimum is set at $0.686 as of this morning. One analyst expects the bears can push the pair much lower today, to about $0.65.

At the time of writing, XRP was trading at $0.6734.

BNB/USD

Binance Coin (BNB) has fallen 11.67 percent in tandem with Bitcoin (BTC).

BNB appears to be on its way to the mirror level of $385 on the daily chart. As a result, continued seller pressure is bolstered by higher trading volume, amplifying the bearish trend.

If the price settles below $385, however, a further slide to the most liquid zone around $340 is possible.

At the time of writing, BNB was trading at $415.4 per share.

ADA/USD

Cardano (ADA) is the biggest loser today, having down 15.77 percent from yesterday.

Despite the increasing trading volume, Cardano has almost reached the support level of $1.072. If there is a false breakout, there is a potential of a rebound back to the $1.4 zone. If the daily candle closes below this level, the decline could continue, bringing ADA below $1.

At the time of writing, ADA was trading at $1.192.