The total market volume of cryptocurrencies has decreased during the last 24 hours, decreasing by 42.47 percent. Here are some price analysis as of today

While Bitcoin’s price was hovering around $33,000 at press time, the fortunes of the altcoins were a mixed bag, with some making tiny gains and others still trading in the red.

At the time of writing, Binance Coin, Litecoin, and Chainlink had all hit monthly lows and were on the mend.

At the time of writing, BNB was trading at $291.36.

It surged to $308 yesterday after a sustained slide from $344 to $264, before plunging again.

BNB

BNB was at its monthly low of $225 just a few days ago, a flashback from over a month ago. However, it did not fall below $280 after its rebound.

A bullish trend was crawling up the charts, according to the Awesome Oscillator. The parabolic SAR agreed, indicating a bullish trend as well.

Finally, the Bollinger Bands on the charts began to converge, indicating that volatility was low and that no significant price moves were expected in the foreseeable future.

LTC

Litecoin formed a lower price range on the charts, going below $132. The coin’s price had dropped to $119 on June 22nd, its lowest level since May 23rd.

Following a 20.8 percent decrease in the previous seven days, there were signs that the cryptocurrency was making tiny gains in the recent 24 hours, with LTC up 0.7 percent.

It’s worth noting, though, that the support range at press time was $131, which was lower than the preceding range.

The Stochastic RSI was over 80 on the 4-hour chart, indicating a likely market drop. The presence of a strong trend, which may diminish and cause the market to become less directional in the future, was depicted by the Average Directional Indicator.

After briefly approaching the neutral zone, the Chaikin Money Flow positioned itself below the zero-line, indicating that capital outflows remain larger than capital inflows.

When Coinbase Japan was recently approved by Japan‘s Financial Services Agency to conduct crypto-exchange services, Litecoin was one of the five coins featured on the exchange.

LINK

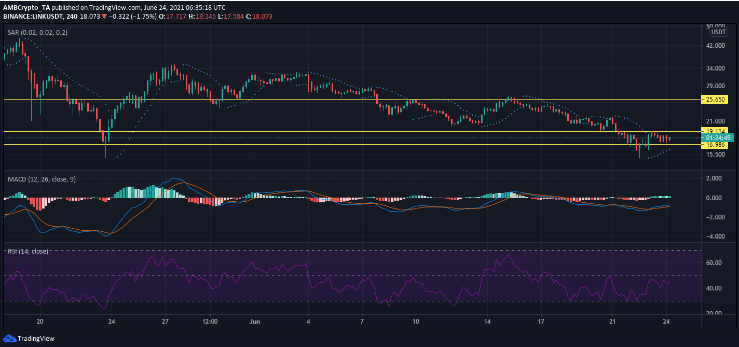

At publication time, LINK was trading at $18.3, down 2.7 per cent in 24 hours. Its trading volume was approximately $1 billion, and it had dropped by 58.17 per cent since yesterday.

Since June 21, the price of LINK has been consolidating between the $17 support and $19 resistance levels. LINK, like other altcoins in the market, hit its monthly low on the lower price range of $15 after the 24th of May.

The Relative Strength Index (RSI) was rising on the charts, indicating more purchasing pressure. A bullish crossover was depicted by the MACD and Signal lines.

Finally, the markers of the parabolic SAR were below the candlesticks, indicating a positive trend. As a result, the price may experience additional northbound movement in the near future.

Glitch Finance, a decentralized finance (DeFi) blockchain startup, recently announced that it will be “integrating Chainlink Price Feeds as the preferred oracle solution for the Glitch Network to accelerate the development of fully interoperable DeFi applications and secure our decentralized governance model.”