Eigenlayer-based liquid staking project Puffer Finance has raised $18 million in Series A funding to launch its mainnet.

The announcement on April 16 stated that Brevan Howard Digital and Electric Capital led the funding round, with significant contributions from Coinbase Ventures, Kraken Ventures, Lemniscap, Franklin Templeton, Fidelity, Mechanism, Lightspeed Faction, Consensys, Animoca, GSR, and additional angel investors.

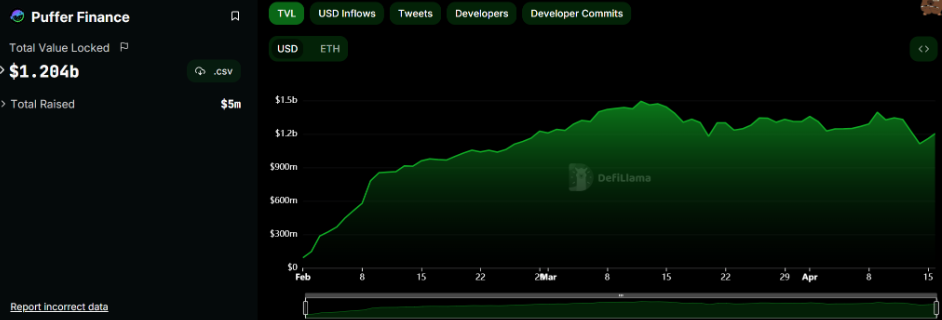

Shortly after its early test phase concluded in February, Puffer Finance surpassed a total value locked (TVL) of $1.2 billion, according to data from DefiLlama. The protocol has obtained venture capital funding of $23.5 million as of the current date.

“Puff obtained a strategic investment from Binance Labs after this funding round, thereby strengthening its standing in the Liquid Restaking ecosystem,” Puffer Finance stated in its announcement, alluding to “technological advancements” that occurred concurrently with the introduction of its mainnet.

The technology of Puffer Finance enables Ethereum validators to stake a single Ether instead of the 32 ETH that individual stakes are required to stake.

Furthermore, individuals who utilize Puffer to stake Ether are awarded Puffer liquid restaking tokens (nLRTs), which may be used concurrently with the rewards earned from staking Ethereum to cultivate yields in alternative decentralized finance protocols.

Other decentralized ledger systems, including Cosmos, have long utilized the liquid staking process; Ethereum only adopted it in late 2017 following the Merge upgrade, which transferred the network to proof-of-stake.

Pursuing the most advanced liquid restaking protocol, we intend to lower the barriers to entry for home validators substantially,” said Amir Forouzani, a core contributor at Puffer Labs, in a press release.

After temporarily eliminating a limit on the amount users could stake, EigenLayer surpassed the decentralized finance lending protocol Aave in TVL on March 6, according to Cointelegraph. The protocol now commits $10.4 billion worth of cryptocurrency.

According to data from Dune Analytics, EigenLayer has more than 107,900 unique depositors, and DefiLlama notes that 74% of staked tokens are Lido Staked Eth (stETH) and Wrapped Ether (wETH).

With approximately 160 protocols and a secured value of nearly $55 billion, liquid staking protocols are currently the largest DeFi protocol category. This is primarily due to Lido, the largest protocol by locked value at $35 billion.