A hacker in the Radiant Capital DeFi attack transferred about $52M from Arbitrum and Binance’s BNB Chain to Ethereum.

It is probable that the hacker who was responsible for the recent loss from the decentralized finance (DeFi) protocol Radiant Capital has migrated almost all of the stolen funds from layer-2 protocols to Ethereum in an effort to conceal its whereabouts.

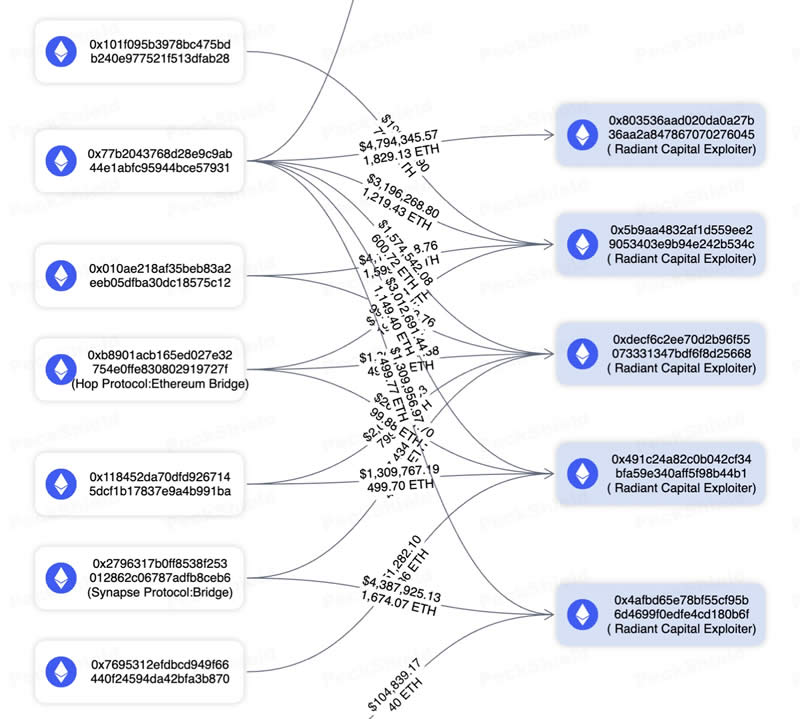

On October 24, PeckShield, a blockchain security company, announced that addresses linked to the Radiant Capital exploiter had successfully transferred “nearly all” of the cryptocurrency from the layer-2 network Arbitrum and the Binance BNB Chain to the Ethereum network. According to PeckShield, the total amount that was transferred was around 20,500 Ether, equal to approximately $52 million.

Radiant Capital issued a warning to consumers on the 23rd of October to safeguard their wallets by rescinding approvals for affected smart contracts. If you disregard the warning, you run the risk of depleting your money. Following the breach of cybersecurity that occurred on October 16, the cross-chain DeFi lending protocol ceased its lending markets.

The intrusion resulted in the theft of more than fifty million dollars. Nevertheless, this was not a typical attempt to exploit a smart contract. The team published a post-mortem of the incident on October 18th, which revealed that the attackers had infiltrated the devices of at least three main developers at Radiant by using a “sophisticated malware injection.

This gave the attackers the ability to operate the multisignature wallet. Radiant Capital is a decentralized finance platform that operates across many blockchain networks, including Ethereum, BNB Chain, and Arbitrum, and enables users to earn interest and borrow assets, among other things.

DefiLlama reports that since the exploit, the entire value of Radiant Capital has decreased by approximately 36 percent, currently hovering around 24 million dollars. At this point in the year, this is not the first time that Radiant Capital has been compromised. The lending markets on the platform were shut down in January as a result of a flash loan scam that included $4.5 million.

There is a common practice among hackers and cybercriminals to use Ethereum as a stepping stone in order to conceal their illicitly obtained gains by utilizing mixers such as Tornado Cash. The majority of the crypto hacks and exploits that have occurred this year, including WazirX, CoinStats, Orbit Chain, Pancake Bunny, Unizen, and Penpie, have utilized this particular strategy as their primary means of attack.

Swapping to Ether quickly can help the hacker secure their funds before any preventative measures are taken by authorities or the issuers of centralized tokens. Swapping to Ether quickly can help the hacker secure their funds.” During the month of September, PeckShield claimed that the total amount of money lost due to crypto attacks exceeded 120 million dollars. Over the course of 2024, it was the second-lowest monthly loss.