The Reserve Bank of Australia (RBA) has announced that it will not pursue a retail CBDC. Instead, the bank will concentrate on the launch of a wholesale CBDC.

During a speech at the Intersekt Fintech Conference in Melbourne on September 18, RBA Assistant Governor Brad Jones unveiled the Australian central bank’s three-year roadmap to establish a wholesale CBDC.

“I can confirm that the RBA is making a strategic commitment to prioritize its work agenda on wholesale digital money and infrastructure – including wholesale CBDC – rather than retail CBDC.”

Jones stated that the RBA’s research had determined that a retail CBDC in Australia would provide minimal authentic innovation for public use. In contrast, a wholesale CBDC would offer numerous significant benefits to commercial and central banks.

These benefits include the reduction of counterparty and operational risks, the enhancement of liquidity and transaction capabilities, the reduction of intermediary and compliance costs, and the increase in transparency and auditability.

He further stated that the potential benefits of a retail CBDC for the Australian public were “modest or uncertain.”

A retail version of the digital currency would introduce a variety of challenges, such as higher borrowing costs, an increased risk of bank runs, and difficulties in implementing the appropriate monetary policy.

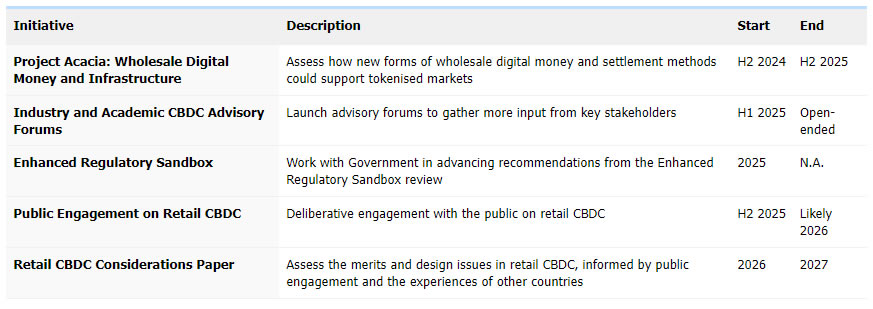

According to Jones, the central bank’s “most immediate priority” is to initiate the public phase of Project Acacia. This initiative will investigate wholesale CBDC and tokenized commercial bank deposits.

Project Acacia aims to expand upon the central bank’s prior research on CBDCs and investigate potential cross-border applications in collaboration with regional central banks.

It also intends to establish industry and academic CBDC advisory forums, support regulatory sandbox reforms for financial innovation, and engage the public on a retail CBDC.

Jones also observed that the RBA was conducting additional research to investigate the potential advantages of asset tokenization and the role of blockchain and smart contract technology in the central bank’s financial operations.

“The programmability of tokens via smart contracts, and the ability to free up collateral and reduce counterparty risk by atomically exchanging money and assets on the same ledger, have been of particular interest in experimental research.”

According to the Atlantic Council, 134 countries, which account for 98% of the global GDP, are involved in exploring central bank digital currencies.

It also disclosed that 66 countries are in the advanced exploration, development, pilot, or launch stages.