In the last 24 hours, the crypto market saw its biggest liquidation which led to a downward trend in the prices of most cryptocurrencies including Bitcoin. This singular move led to the market having its worst day in the past six months.

Over $2.5 billion worth of leveraged positions were liquidated in the crypto market mayhem over the previous 24 hours, making it the biggest liquidation day in 15 months. Over $500 billion was wiped out in a matter of hours, bringing the whole market cap down by roughly 20%.

Some probable reasons for the dip

A variety of causes are said to have precipitated the crypto market crisis that flipped sentiments on their heads.

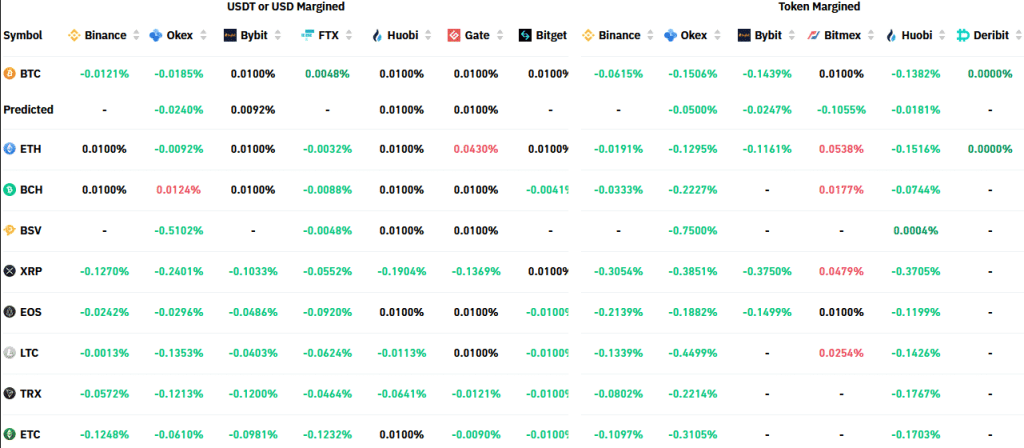

The new COVID version Omnicorn appears to be the principal cause of concern in the traditional market. Other variables that caused the crypto market fall, according to market observers, were overly leveraged positions and exorbitant financing rates on exchanges.

Even if the majority of the market is trading in red, the crypto funding rates have turned negative again, which many believe is a bullish indication.

Many believe that the recent drive for restrictions in the United States, as well as calls for harsh policies on the crypto market, particularly stablecoins, contributed to the latest meltdown.

On December 8th, the Congress will convene a hearing at which CEOs from top crypto platforms including Coinbase, FTX, and others will appear and try to fight for progressive rules.

Is there a possible recovery soon?

Crypto pundits projected a positive fourth quarter after a particularly strong October, but the start of December suggests otherwise.

After a dismal month and a half, the Bitcoin Fear and Greed Index has plunged to “Extreme Fear.” Despite the fact that the crypto market is currently in a negative downturn, market analysts believe we have yet to achieve a market top.

Plan B, a well-known crypto analyst who predicted a $100K Bitcoin price based on a stock-fto-flow chart, posted a 2017 bull cycle graphic, indicating that the crypto market would absorb the losses before returning the bulls.

For context, 2017 bull market pic.twitter.com/W16gCwTVve

— PlanB (@100trillionUSD) December 4, 2021