Due to unfavorable market circumstances, Robinhood, the US-based stock and cryptocurrency trading platform allegedly obtained a 60% discount on the first offer offered to Ziglu.

Because of unfavorable market conditions, stock and cryptocurrency investing platform Robinhood allegedly received a 58% discount on its $170 million bid to purchase crypto exchange Ziglu.

Robinhood made its original offer in April, but according to a number of internet stories published around August 17, the business reduced it to $72.5 million due to unfavorable market circumstances. On August 18, Ziglu CEO Mark Hipperson apparently accepted the offer.

The collapse of numerous significant centralized crypto lenders, including BlockFi, Celsius, and Voyager, as well as other macroeconomic issues like the Russian invasion of Ukraine, are among the many causes that Robinhood is alleged to have emphasized.

According to report, the overall market worth of cryptocurrencies has decreased by about 40% since April, which put tremendous pressure on Robinhood to reevaluate the amount it was ready to invest in UK-based Ziglu.

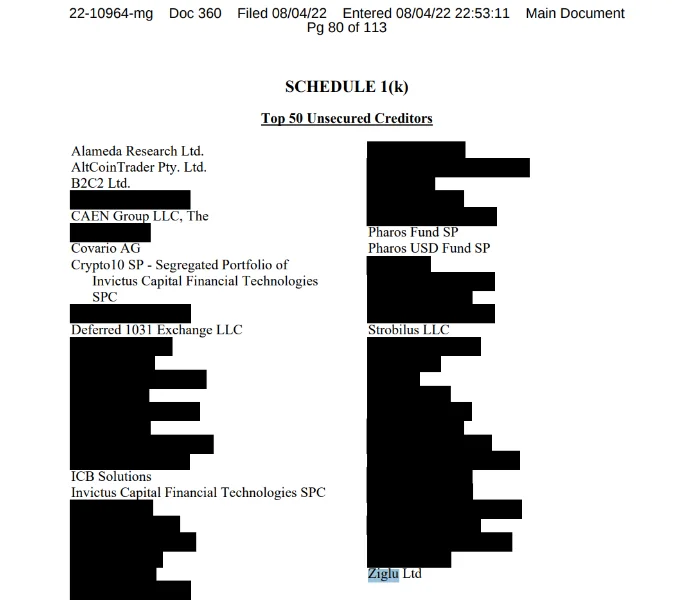

Ziglu is one of the top 50 unsecured creditors of the insolvent cryptocurrency lender Celsius, according to the list. Since the lender is rapidly out of cash and has been operating at a multi-billion dollar loss while it is going through bankruptcy, Ziglu’s funds on Celsius may be permanently frozen.

Ziglu was acquired by Robinhood as part of the company’s strategy to gain traction in the UK market, but if Ziglu rejects the revised offer, the Robinhood team, headed by CEO Vlad Tenev, may have to start from scratch.

Ziglu seems to be stuck between a rock and a hard place as a result of the new conditions. Founder Mark Hipperson said in a letter to investors that his business would be left in a “very tough market, and undercapitalized for the years ahead” if the first $170 million investment were to be terminated.

An inquiry for comments was not immediately answered by a Ziglu spokesperson. Despite having reservations about the reduced number, Hipperson told fintech news source Altfi that “we feel the amended proposal…is the best and only logical road ahead for the firm.”

When Ziglu’s most recent round of investment was completed in November of last year, the company’s stock price increased to $58.12. With the new agreement, shares now cost $34.04.