As stated in the Wall Street Journal, the SEC has instructed at least one asset manager not to proceed with preparations for a leveraged Bitcoin ETF.

According to a report, the US Securities and Exchange Commission (SEC) would not allow leveraged Bitcoin Exchange-Traded Funds (ETFs).

An exchange-traded fund is a type of financial product that monitors the price of a certain asset. This means that investors can invest in the asset without actually owning it.

There are several advantages to investing in an ETF rather than the asset itself. In the case of Bitcoin, investors who are unfamiliar with the crypto world may consider such a fund an easier way to invest because they no longer need to deal with digital currency exchanges and wallets.

Another advantage is the ability to trade both long and short positions. When you hold BTC, you only profit when the price rises. However, trading in ETFs allows for gains in either way.

The ProShares ETF became the first Bitcoin fund to start earlier this month, and it saw record-breaking demand. Asset managers are now trying to launch more crypto-related products, with a leveraged ETF being one of the possibilities.

However, as previously stated, the SEC has already barred one of the prospectors from proceeding with it.

“Regulators have been limiting product launches in an effort to reduce investor exposure to products that they believe prone to fraud, manipulation, and other dangers,” according to the paper.

BTC ETFs Set New Records in Their First Week

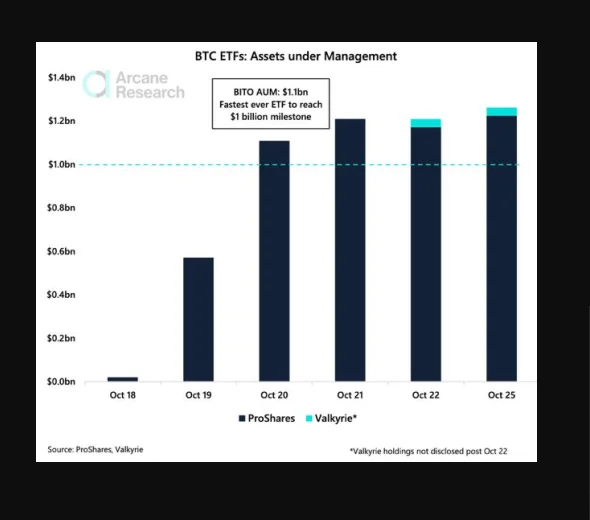

According to the most recent Arcane Research study, the Bitcoin ETF debut 10 days ago was a huge success, with tremendous numbers in the first week.

ProShares‘ BITO fund became the fastest to reach $1 billion in assets. It took two days to reach the milestone, whereas the SPDR Gold Shares took three days.

Valkyrie’s BTF also debuted last week, with a trading volume of roughly $80 million on day one. This made the ETF the 15th most successful launch in history.

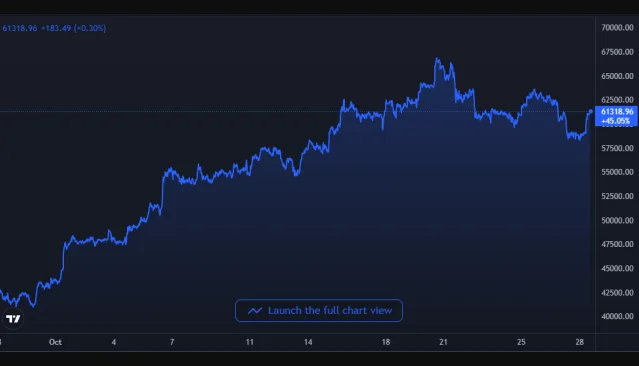

The debut of the ETF boosted Bitcoin’s price, allowing it to achieve a new all-time high slightly below $67k.

Here’s a chart showing how the coin has risen in value over the last month: