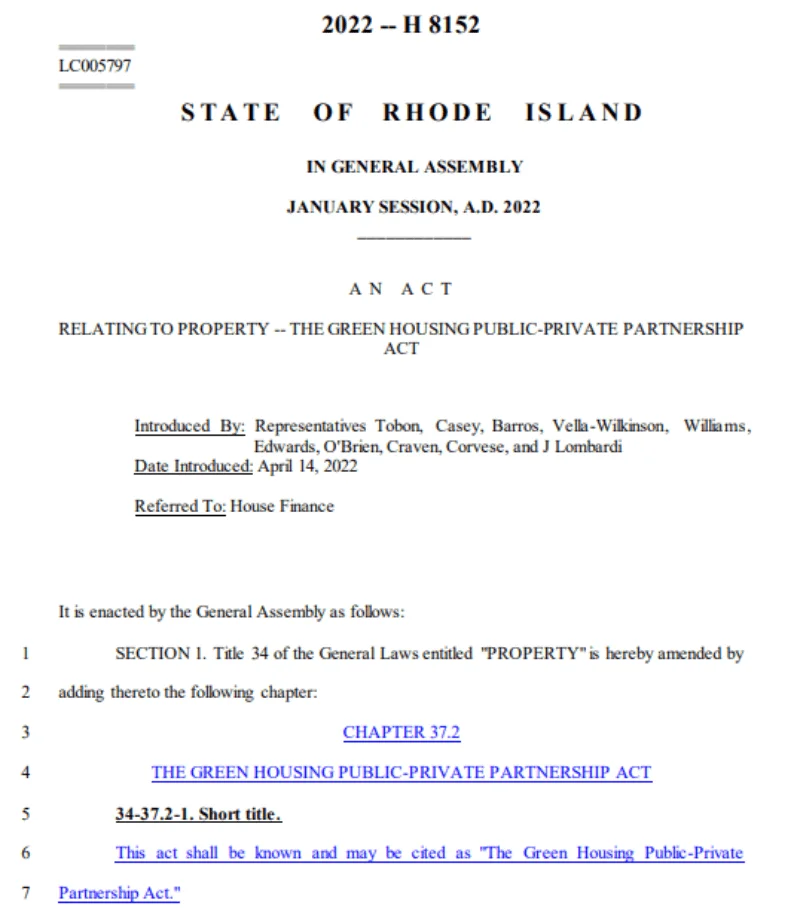

House of Representatives in Rhode Island have introduced a bill that would tackle the housing shortage by rewarding home builders with “green coin” cryptocurrency for lowering the project’s carbon footprint.

The Green Housing Public-Private Partnership Act would require a housing project’s utility costs and carbon emissions to be reported annually to the state’s public utility commission. If the project is able to lower its utility expenses, the state will give the property owner a cryptocurrency credit.

“Any reduction 24 amount of utility costs attributable to any housing construction project pursuant to this chapter shall 25 be assigned a credit amount which credit shall be eligible for redemption in a byway of cryptocurrency in the form of a green coin.”

The plan would be funded by $500 million in private bank donations and $125 million from the state, which would be known as the “Green Housing Fund.”

The Green Coin’s blockchain network is unknown, however it is likely to be a less expensive proof-of-stake (PoS) network, which is popular with mainstream environmentalists these days.

The bill is intended to address both the unexpected increase in housing demand in the Ocean State and to incentivise home builders to adhere to environmental regulations. The suggestion reads as follows:

According to a report from local news outlet The Providence Journal, the newly proposed policy is intended to boost new housing developments in the state, which is experiencing a housing crisis aggravated by rising costs year after year.

Redfin, a home data tracker, reveals that Rhode Island’s housing supply has been steadily declining for the past five years, with a five-year low in February 2022.

While the Rhode Island legislature’s intention to award environmentally conscious builders with cryptocurrency is novel, cryptocurrency in the real estate market is not. Taking out crypto mortgages to help pay for a home is becoming more frequent.

Real estate and crypto

Late last month, the USDC.homes program provided a loan in USD Coin (USDC) on the Polygon network to a new homeowner in Austin, Texas.

The uncollateralized loan works similarly to regular loans, except that the down payment, which is also made in crypto, is staked to earn the borrower interest, which may be used to reduce the principle.

Since November, Bacon Protocol has been selling nonfungible token (NFT) mortgages with interest rates well below the national average of 5.5 percent.