Ripple CEO Brad Garlinghouse acknowledged that Ripple should have engaged with U.S. regulators earlier, leading to legal challenges.

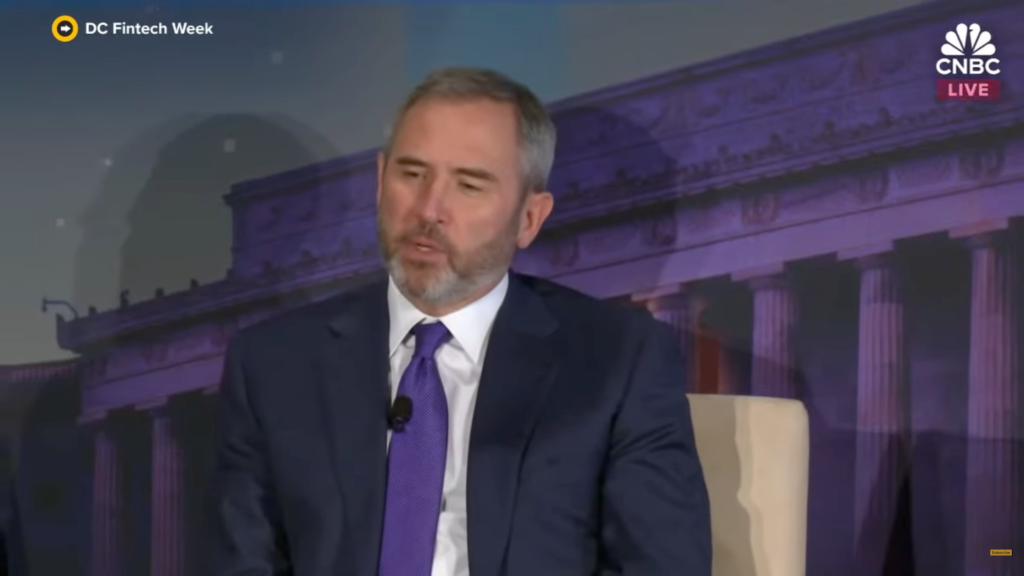

Ripple CEO Admits Mistake

The CEO of Ripple Labs, Brad Garlinghouse, has admitted that his company should have worked with US regulators sooner. Ripple Labs and the crypto business are playing catch-up after being hit with legal actions.

In an Oct. 23 speech at DC Fintech Week, Garlinghouse said, “I’ve made many more trips to DC in the last few years than I did in the years before that.”

“I look back on that, and I regret that. I think we made a mistake by not leaning in earlier, and we’re trying to make up for lost time to some degree.”

One US crypto company that has recently been in a legal fight with the Securities and Exchange Commission is Ripple. Many US crypto executives say that the SEC is biased and unfair to the industry.

In early 2018, the SEC won part of its long-running case against Ripple when a judge found that the company sold its XRP token to institutions as an unregistered investment.

But XRP wasn’t a security when it was sold to regular people on crypto exchanges. The SEC took this argument to a higher court earlier this month, and Ripple wants to fight it.

Garlinghouse told the crowd in Washington, DC, that the US “lags behind” other countries when it comes to crypto laws. He blamed SEC Chair Gary Gensler for starting a “reign of terror” against the industry and said Senator Elizabeth Warren was “spreading misinformation” about crypto.

He added that part of “leaning in” is “just education” and showing that the crypto space has “serious people doing serious things,” adding:

“It doesn’t help that you had Sam Bankman-Fried showing up on Capitol Hill with cargo shorts and selling something that turned out not to be exactly what was represented.”

“That hurt the whole industry, that hurt Ripple,” Garlinghouse said.

He also said that Ripple has paid much money to election campaigns. The company has given almost $50 million to the pro-crypto FairShake PAC this election cycle. This group has backed both Republican and Democratic politicians.

Chris Larsen, co-founder of Ripple, said on October 21 that he gave $10 million to a PAC that supports Kamala Harris for president.

XRP ETF is “inevitable”

The same day, Garlinghouse told Bloomberg Television that XRP would be offered in a spot exchange-traded fund (ETF) in the US. He said it was “just inevitable.”

Since January, more than $21 billion has flowed into spot Bitcoin ETFs, he said. This “clearly shows that there’s demand from institutions and demand from retail to access this asset class.”

“People are more interested in XRP,” Garlinghouse said. “The price of XRP has been the subject of two or three ETF filings. I think it’s inevitable that you’ll see an XRP ETF along with Bitcoin and Ether.”

As of now, only Bitwise and Canary Capital have filed with the SEC to start a spot XRP ETF.

This is what Garlinghouse thought: an XRP fund “will do quite well.” He said this because the cryptocurrency has a “very interested and active community” in the US and other countries.

He added crypto ETFs are part of a trend of “more and more institutionalized participation in the crypto industry.”

“I think we’ll continue to see that,” he said. “I do think it creates upward pressure on the prices for many different cryptos, including XRP.”