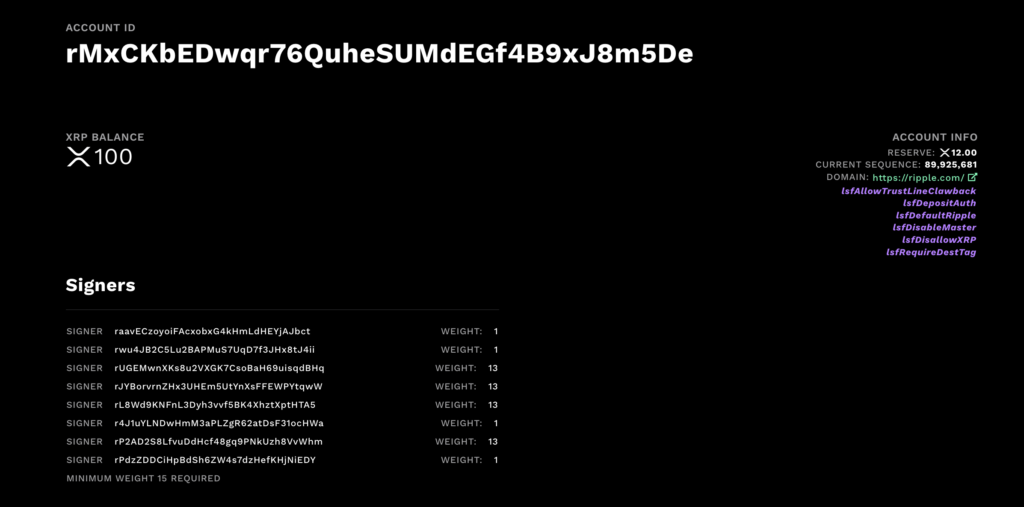

On August 9, Ripple Labs reported the initial tests of its US dollar-pegged stablecoin, Ripple Labs’ Ripple USD (RLUSD), on the Ethereum mainnet and the XRP ledger (XRPL).

The upcoming stablecoin, RLUSD, will be overcollateralized, meaning that each unit is supported by USD reserves or short-term cash equivalents in a bank at a 1:1 ratio to the US dollar, as per Ripple Labs. Ripple also committed to publishing monthly reports on the reserves and conducting third-party audits of the underlying currency assets to ensure transparency and accountability.

The crypto firm also reaffirmed its dedication to utilizing XRP and RLUSD to service markets, dispelling rumors that it would abandon XRP to concentrate on its new stablecoin.

The stablecoin was beta testing with enterprise partners, and Ripple Labs emphasized in the announcement that it was not presently available for purchase or live trading.

The company also warned users against scammers who claimed to sell or provide early access to RLUSD.

SEC Lawsuit Results in $125M Penalty for Ripple

Following a ruling from Judge Analisa Torres on August 7, which imposed a $125-million penalty on Ripple Labs in the Securities and Exchange Commission’s litigation, initially filed in 2020, the mainnet tests of RLUSD were conducted.

The SEC had requested that the court impose a staggering $2 billion punishment against Ripple Labs for the alleged securities violations detailed in its lawsuit. Ripple CEO Brad Garlinghouse hailed the penalty as a “victory” against the SEC.

Unsurprisingly, the price of XRP responded to the news with positive price momentum, reaching a high of $0.64 on the same day the ruling was issued and surging by 26%.

XRP Ledger Sees decline in transaction volume

According to Ripple Labs‘ Q2 2024 XRP Markets Report, the XRPL experienced a 65.6% decrease in transaction volume in the second quarter of 2024 despite positive developments for Ripple.

The report from Ripple indicated a substantial increase in the average cost per transaction on the ledger and a steep decline from 251,397,881 transactions in the first quarter to 88,388,029 transactions in the second quarter.