According to internal company messages, roughly 7% of full-time staff, amounting to 150 employees, are being laid off by online brokerage firm Robinhood Markets.

According to an internal company message seen by The Wall Street Journal, Robinhood’s chief financial officer, Jason Warnick, stated that the reductions were made to “adjust to volumes and better align team structures.”

In a comment, a Robinhood spokesperson did not corroborate or deny the layoffs but stated:

“We’re ensuring operational excellence in how we work together on an ongoing basis. Sometimes, this may mean teams make changes based on volume, workload, org design, and more.”

The reported layoffs occurred just five days after Robinhood’s $95 million acquisition of credit card company X1. In April last year, Robinhood reduced its total personnel by nine percent.

In August, it let go of twenty-three percent of its remaining employees due to a decline in trading activity and depressed prices for equities and cryptocurrencies.

The two layoffs resulted in the loss of over a thousand employees.

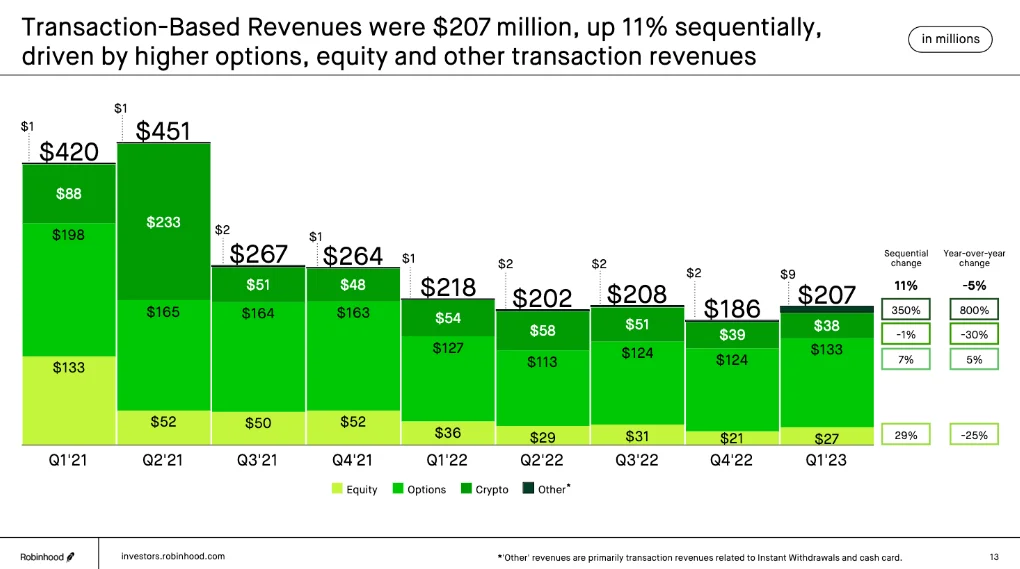

During its zenith in the second quarter of 2021, Robinhood had more than $565 million in revenue and 21,3 million active users.

Robinhood’s results for the first quarter of 2023 indicate a 44% decline in monthly active users and a 30% year-over-year decline in revenue, indicating a recent decline in fortunes.

Currently, shares of Robinhood are trading for $9.63, up 18% year-to-date despite having dropped more than 82% from its August 2021 all-time high.