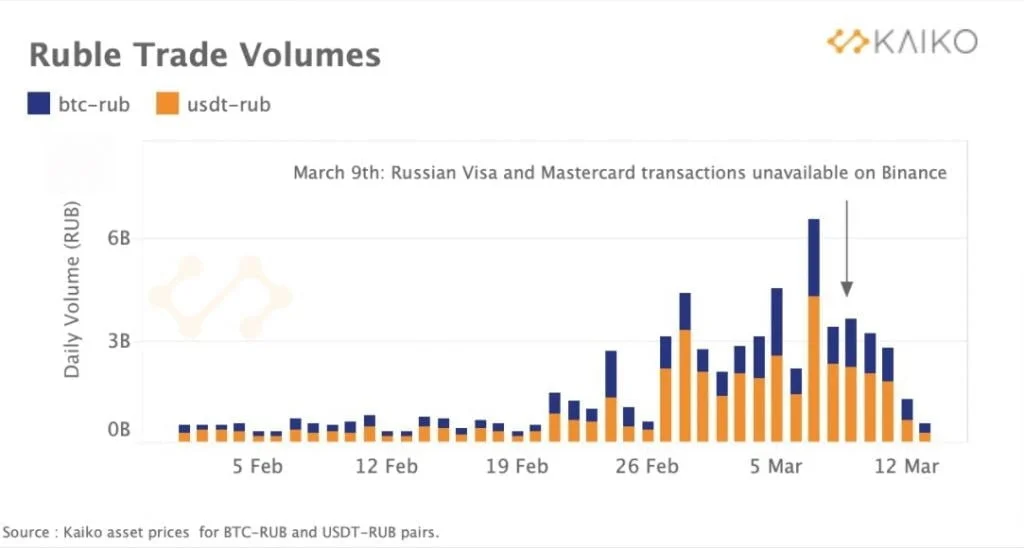

Binance blocked Visa and Mastercard cards issued in Russia, causing crypto trade volumes to fall.

While Russian citizens still have access to cryptocurrency exchanges, sanctions on traditional payment channels appear to be limiting their ability to trade.

While most crypto exchanges oppose blanket bans on Russian users, many have stopped taking payments from sanctioned banks and services, limiting Russians’ access to cryptocurrency. People are also afraid of storing their wealth in bitcoin for fear of losing access.

Visa, Mastercard, and American Express have all suspended operations in Russia, citing US sanctions as the reason. The majority of foreign banks have also stopped doing business in the country.

According to data from digital asset analytics source Kaiko, ruble-denominated Bitcoin and Tether trade volumes have slowly decreased since Binance’s decision last week, and are now at levels observed prior to Russia’s invasion of Ukraine.

A divergence between ruble and hyrvnia-denominated crypto trading was also highlighted by Kaiko. Following the invasion, BTC-UAH buying soared, showing that traders in Ukraine were flocking to crypto in the face of financial uncertainty.

Trading volumes in Ukraine have remained high, with Tether, in particular, showing strong demand. As the hyrvnia collapsed, citizens were spotted paying up to a 20% premium for the stablecoin.

However, it was only after the application of sanctions, notably the exclusion of Russian institutions from the SWIFT network, that BTC-RUB volumes began to rise. Sanctions imposed by the West on Moscow are the toughest they’ve ever been, effectively cutting Russia off from major global financial markets.

The United States recently imposed a ban on Russian oil imports, and Europe is considering doing the same. Given that oil is Russia’s major export, this would further destabilize the Russian economy.

The ruble recovered from its all-time low against Bitcoin.

The Russian ruble has recovered from record lows against Bitcoin owing to lower BTC-RUB trade activity. One Bitcoin is now worth roughly 4.6 million rubles, down somewhat from last week’s peg of over 5 million rubles.

Still, the ruble is still under a lot of pressure in the exchange market. It is now trading at near-record lows against the dollar and the euro.