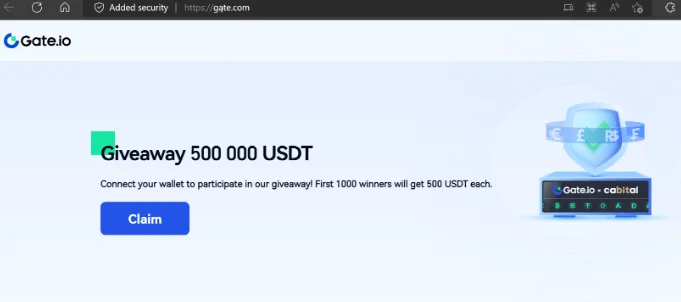

Over a million users of the cryptocurrency exchange Gate.io were at risk of losing money due to an ongoing scam involving a fake giveaway of 500,000 Tether (USDT)by the hackers on the exchange’s official Twitter account.

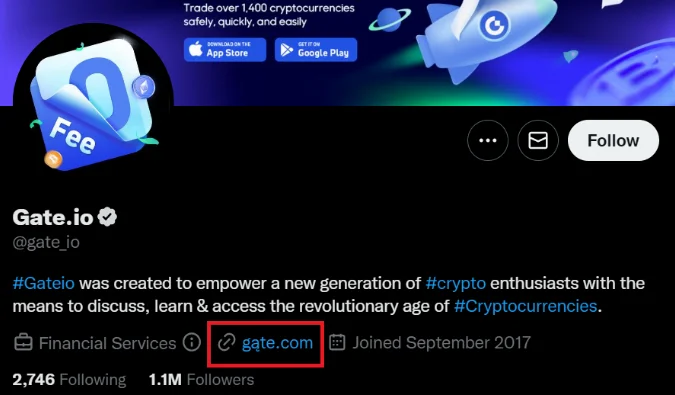

Unknown hackers took control of Gate.io’s Twitter account and changed the URL of the website from Gate.io to gte.com (https://xn—gte-ipa.com/), a fake exchange-impersonating website.

The most efficient way to connect with the cryptocurrency community is through the social media site Twitter. As a result, the practice of using verified accounts’ official Twitter names to spread scams is becoming more popular.

The fraudulent Gate.io website actively advertises a fictitious giveaway of 500,000 USDT and requests that visitors connect their wallets (like MetaMask) in order to get the rewards. The moment a person links their wallet to the fraudulent website, the hackers have access to their existing funds and can start draining their assets.

As it identified the phishing website and warned users about the possibility of losing private keys, blockchain investigator Peckshield also confirmed the attack was still active.

Investors are encouraged to double-check the website URLs of the trading platforms to guarantee the integrity of the offerings at a time when cryptocurrency frauds are predicted to reach all-time highs.

The Federal Bureau of Investigation (FBI) of the United States recently issued a warning that scammers are increasingly using cryptocurrency ATMs to collect money from victims.

According to the FBI, con artists utilize wire transfers, prepaid cards, and crypto ATMs to evade law enforcement:

“Many victims report being directed to make wire transfers to overseas accounts or purchase large amounts of prepaid cards. The use of cryptocurrency and cryptocurrency ATMs is also an emerging method of payment. Individual losses related to these schemes ranged from tens of thousands to millions of dollars.”

As soon as the victims agree to pay up, the con artists demand that they pay more taxes, “leading them (investors) to lose additional monies.”