The SEC has approved Ethereum ETFs from multiple firms, allowing them to start trading in the US.

The day has finally arrived: Ethereum ETFs have been officially authorized for trading in the United States.

The US Securities and Exchange Commission (SEC) has permitted registration forms from 21Shares, Bitwise, BlackRock, Fidelity, Franklin Templeton, VanEck, and Invesco Galaxy, as well as the Grayscale Ethereum Trust and the Grayscale Ethereum Mini Trust, as of yesterday afternoon.

“The launch of the 21Shares Core Ethereum ETF (CETH) marks a significant milestone for 21Shares and for U.S. investors. Today’s approval represents further proof that crypto as an asset class is here to stay,” said Ophelia Snyder, co-founder and president of 21Shares, in an emailed statement.

The Ethereum ETFs were technically authorized by the SEC in May; however, the firms were required to wait for their registration statements to become effective before they could launch on exchanges.

Since then, the market has been anticipating the launch with great anticipation, weathering numerous delays. The Ethereum ETF launch was initially scheduled for July 2, but it was postponed after the regulator returned the S-1 forms to potential ETH ETF issuers.

Cynthia Lo Bessette, head of digital asset management at Fidelity, said the firm’s ETH ETF will give investors exposure to Ethereum through “thoughtful index and product design supported by a dedicated operations and trading team and industry-leading security.”

“This is exemplary of Fidelity’s rich history and commitment to meeting the evolving needs of our customers,” Lo Bessette added.

The introduction of Ethereum ETFs follows the successful launch of Bitcoin ETFs six months ago, which have garnered more than $16 billion in inflows.

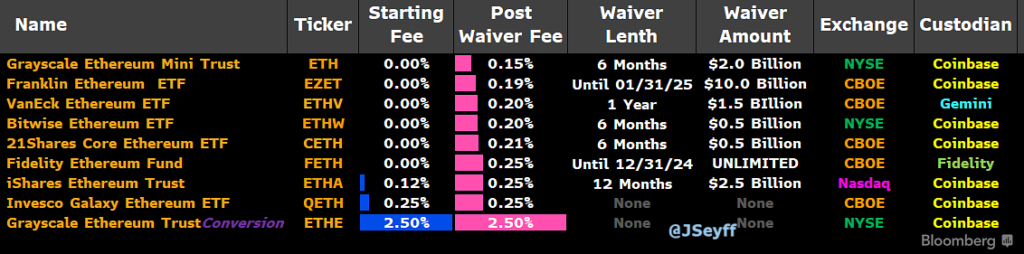

The table below displays the proposed fees for the ETH ETFs, as revealed by Bloomberg analyst James Seyffart on X/Twitter. Grayscale changed the fee waiver specifications to 0% for the initial six months.