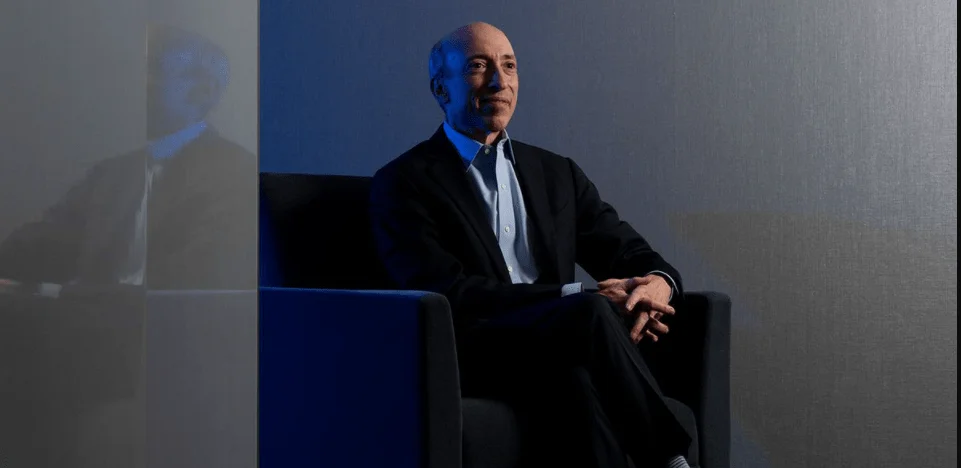

Gary Gensler, chairman of the Securities and Exchange Commission, advocated for collaboration between Europe and the United States in the effort to regulate decentralized financial innovations.

President of the Securities and Exchange Commission (SEC), Gary Gensler, has appeared electronically before the European Parliament to give his policy suggestions on the regulation of cryptocurrency assets. Gensler is the first chairman of the SEC in the United States to do so.

As part of his testimony before the European Parliament’s Committee on Economic and Monetary Affairs on September 1, Gensler emphasized the role that financial technology are playing in globalizing economic flows and undermining walled national markets:

“I think the transformation we’re living through right now could be every bit as big as the internet in the 1990s.”

In a statement, Gensler described the $2.1 trillion cryptocurrency markets as a “truly global” asset class that “has no borders or restrictions. Every day of the week, it is open at all hours of the day.

When a Finnish lawmaker, Eero Heinäluoma, inquired about the environmental footprint of crypto assets, Gensler generally kept to the same pro-regulation script he’d been following for weeks. However, Gensler did deviate into a new area of discussion.

This, according to a legislator, was more than twice as much electricity consumed by the Bitcoin network as that consumed by the Netherlands and Sweden combined. It also exceeded “the total greenhouse gas emissions reductions of electric vehicles.”

In addition to describing Bitcoin’s environmental impact as a significant “challenge,” Gensler pointed out the rising popularity of more energy efficient Proof of Stake crypto networks (such as Ethereum and Cardano).

He concluded that as the adoption of PoS crypto networks increases, concerns about Bitcoin’s carbon emissions will become increasingly concentrated around Bitcoin.

SEC Chairman Jay Clayton emphasized the importance of developing robust public policy frameworks that strike a balance between fostering innovation in crypto assets and decentralized finance while also ensuring that investors are protected to the greatest extent possible.

However, Gensler cautioned that while DeFi platforms “provide direct access to millions of investors” without the need for a broker to act as a go-between between the general public and the protocol, they also posed significant dangers.

“DeFi and crypto have been rife with fraud, scams, and abuse,” he said, emphasizing that the investing public is particularly vulnerable because there are no “clear investor protections obligations on these platforms.”

Concerns about stablecoins were also raised by the SEC’s chairman, who estimated that stable token pairings account for approximately three-quarters of all cryptocurrency trading volumes.

The use of stablecoins, according to Gensler, makes it easier for people trying to circumvent a variety of public policy objectives, including as anti-money laundering protections and international sanctions, to achieve their objectives.

While many people are familiar with the concept of Facebook Diem, he points out that the stablecoin market currently exists and is valued $116 billion.