The US SEC has implemented enforcement actions against crypto firms and executives in 2024, totaling nearly $4.7 billion, representing a more than 3,000% increase from 2023.

According to a report from Social Capital Markets on Sept. 9, the SEC’s record-setting year was primarily attributed to its “largest enforcement action to date,” a $4.47 billion settlement with Terraform Labs and its former CEO Do Kwon in June.

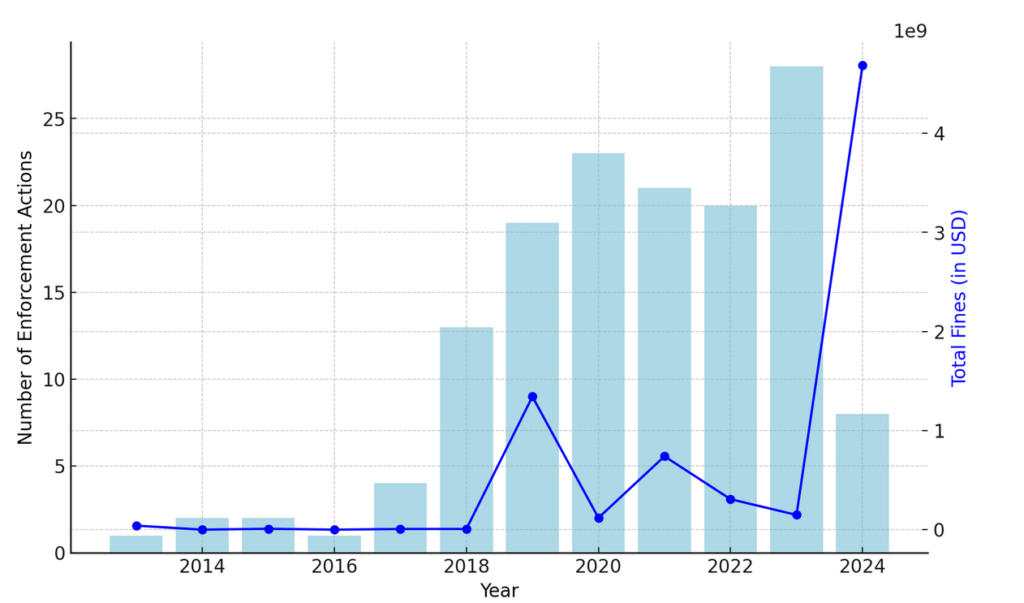

The regulator’s 11 enforcement actions in 2024 resulted in a 3,018% increase from the $150.3 million in fines issued in 2023, although it took 19 fewer actions against crypto firms.

From the SEC’s enforcement action date, the total sanction amounts comprised forfeiture, disgorgement, civil penalties, settlement, and prejudgment interest.

This year’s increased penalties indicate that the SEC has implemented a strategic shift toward focusing on more significant cases.

“This trend suggests a strategic shift by the SEC toward fewer but larger fines, with a focus on establishing precedents for the entire industry through high-impact enforcement actions,” the report stated.

In 2019, the Securities and Exchange Commission (SEC) took action against the social messaging network Telegram, resulting in a $1.24 billion settlement. This settlement included $18.5 million in civil penalties and $1.2 billion in disgorgement payments to investors.

According to Social Capital Market, the case substantially impacted the average sanction, which increased by nearly 2,000% year-over-year to exceed $70 million in 2019.

The average fine fluctuated between $5 million and $35.2 million for four years. However, the Terraform Labs case in 2024 resulted in an average fine exceeding $420 million.

The SEC has imposed penalties on GTV Media Group, Ripple Labs, and fraudsters John and Tina Barksdale that exceed $100 million.

Nevertheless, 46% of the penalties levied since 2020 have been less than $1 million, while 30% were between $1 million and $10 million.