The SEC is investigating Kanav Kariya’s secret agreement with Do Kwon, the president of Terraform Labs, during the collapse of the stablecoin TerraUSD.

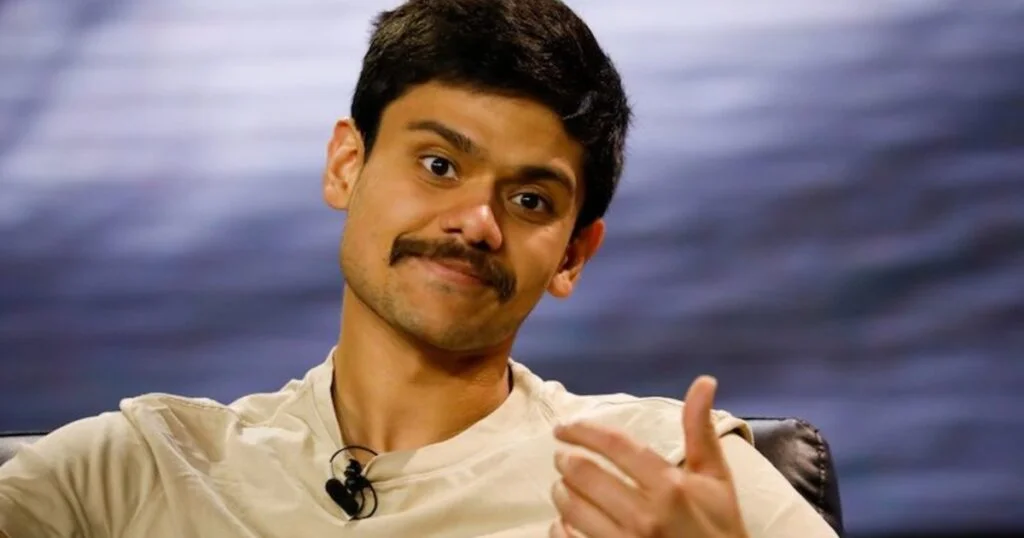

The SEC is investigating whether Kanav Kariya, the former CEO of Jump Crypto, a leading crypto trading firm, entered into a secret agreement with Do Kwon, the president of Terraform Labs.

This blockchain platform issues the stablecoin TerraUSD (UST) and the governance token LUNA. The investigation focuses on Jump Crypto’s involvement in helping to restore UST’s peg by purchasing tokens.

The SEC has alleged that Kwon engaged in a fraudulent scheme worth $40 billion through unregistered securities LUNA and UST.

Kariya and Kwon Suspected of Making a Deal

According to a deposition by SEC counsel Devon Staren, it is suggested that Kariya and Kwon made a deal on May 23, 2021, after UST had depegged.

UST, Kwon’s algorithmic stablecoin, experienced a significant drop in value from around $1 to approximately 0.30 cents on May 9, 2021, and LUNA, the token intended to stabilize UST, plummeted by around 99% by May 12, 2021.

Staren’s questioning revealed that the terms of the alleged agreement were for Jump to help restore UST’s peg by purchasing the token, and in return, Kwon would amend Jump’s LUNA loan agreement and lift the vesting conditions.

However, Kariya invoked his right to resist self-incrimination and declined to answer the question during the deposition.

Jump Crypto Accused of Manipulating UST and AnchorUST Prices

These allegations align with a civil class action suit filed against Jump Crypto, accusing them of manipulating the price of UST and AnchorUST between May 23, 2021, and May 31, 2022.

The lawsuit claims that Kwon agreed to modify prior agreements and provide Jump with over 61.4 million LUNA tokens at a significant discount, which Jump later sold for a profit of over $1.28 billion.

SEC and Terraform Labs Seek Summary Judgment

In the ongoing SEC case against Terraform Labs, both parties have motioned for a summary judgment.

The defense argues that the SEC has not sufficiently proven Kwon’s violation of securities laws, while the SEC contends that token holders were clearly making an investment.

The SEC’s investigation into the alleged deal between Kariya and Kwon is a serious matter that could have significant implications for the crypto industry.

The case also raises questions about the legality and legitimacy of Terraform Labs’ stablecoin and governance token, as well as the role and responsibility of Jump Crypto as a market maker and custodian.