As the price of Ethereum increases despite dropping volumes, it risks negative exposure, but three key on-chain indications point to a different future.

In the previous session, Ethereum (ETH) had risen to a two-month high, indicating that the cryptocurrency’s recent bullish advance was reaching its end.

In more detail, the ETH/USD pair reached a high of $2,699 on Sunday, marking the first time it had done so since June 7. Along with reaching its highest point, the pair’s momentum-gauging relative strength index (RSI) climbed beyond 70, a level considered overbought by analysts.

Traders with short-term risk settings appeared to have sold the Ethereum top in order to lock in temporary profits, resulting in a modest negative correction before the market recovered.

Ether prices climbed by 1.81 percent to $2,600 on Monday, helping to mitigate the dangers associated with Sunday’s sell-off.

As a result of the upswing, traders may still be able to place higher bids for the cryptocurrency, particularly in the days leading up to the Ethereum hard fork upgrade in London, which would — for the first time — introduce deflationary features to the project’s economy through a new base-fee burning mechanism.

Greg Waisman, co-founder and chief operating officer of payment network Mercuryo, predicted that the price of Ether could easily rise above $3,000 following the hard fork, owing to the fact that it will bring a “more flexible and cheaper fee structure” to the Ethereum network, thereby increasing adoption. According to the expert, Cointelegraph:

“The hype buildup with respect to the forthcoming London hard fork is not reflective of the current price trend. […] Ethereum is currently seeing a retracement; it confirms that the sellers are deliberately lowering the price for a post-upgrade price pump.”

Ethereum has notched a 12-day winning streak, the longest ever

The IOMAP indicator reveals that $ETH is sitting on strong support while facing the last 2 key levels of on-chain resistance on its path to $3k once again

Between $2,598 and $2,753, 1.19m addresses bought 2.03m ETH pic.twitter.com/KAP3y0V94i

— IntoTheBlock (@intotheblock) August 2, 2021At least three on-chain indicators that follow the flow of Ether into and out of dedicated addresses predict a prolonged uptrend setup in the coming days.

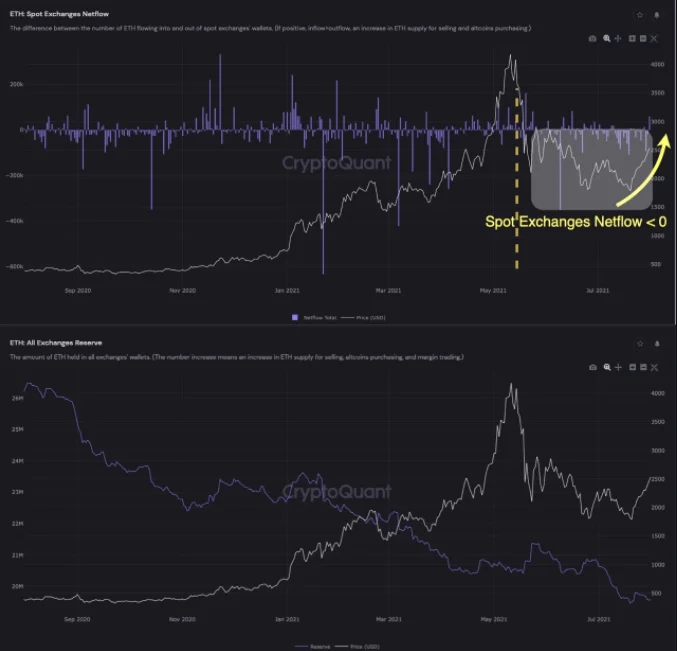

On CryptoQuant, the three measures included tracking Ethereum reserves across all exchanges, their outflow from trading platforms, and the volume of ETH tokens transferred into an Ethereum 2.0 smart contract, amongst other things.

ETH balances on exchanges have decreased, according to CryptoQuant statistics, indicating that fewer traders are interested in swapping ETH for other assets at this time. The outflow of ETH from those exchanges, on the other hand, increased sharply, indicating that traders want to hold their Ethereum until the London hard fork event takes place.

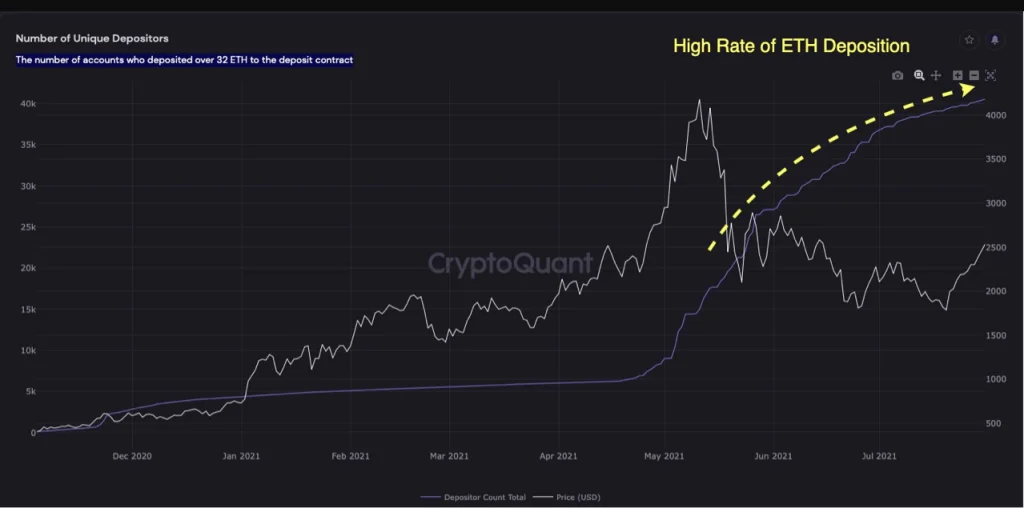

In conjunction with the exchange data, the third on-chain indicator revealed a significant increase in ETH deposits to the smart contract’s bank account.

The details are as follows: users can stake 32 ETH into Ethereum 2.0 smart contracts in order to become validators on the Ethereum blockchain, which is based on proof-of-stake technology. The incentives they receive for batching transactions into a new Ethereum block or checking the work of other validators to keep the chain running securely will depend on how well they perform in this role.

In the eyes of analysts, the occurrence is positive since it removes the active Ether supply from circulation at a time when demand for cryptocurrency is expected to increase.

“The increasing Ethereum 2.0 deposits show a big trust in the future potentials of the Ethereum blockchain, which stirs the scarcity of its native token Ether,” Waisman explained. “The situation may impact positively on the coin’s price.”

“With these positive fundamentals, a return back to the previous all-time high of $4,360 in the long term will be a mild ambition price target for Ether.”