According to Mr. Ye, both real estate giants and real estate dealers in Hong Kong are interested in owning plots of virtual in-game land in various metaverses.

While the metaverse is projected to be the most popular part of the worldwide Web3 ecosystem by late 2021, local analysts believe that fervour surrounding in-game land plots is approaching “fever pitch” in Hong Kong.

Why not use Virtual Property, Instead of Real Estate?

The South China Morning Post published an article by Josh Ye in which he discusses how virtual land is becoming increasingly popular among large-scale Hong Kong property traders and brokers.

Mr. Ye claims that property moguls and real estate traders in Hong Kong are interested in buying virtual in-game land parcels in various metaverses.

The paucity of real-world property in Hong Kong, according to the author, explains why people are interested in virtual plots. The island is well-known for its exorbitant real estate prices.

The average housing price in Hong Kong soared to $1,990 per square foot in Q2 2021. This figure may exceed $3,270 per square foot for smaller families.

Despite a Downturn, Metaverse Tokens are in the Black

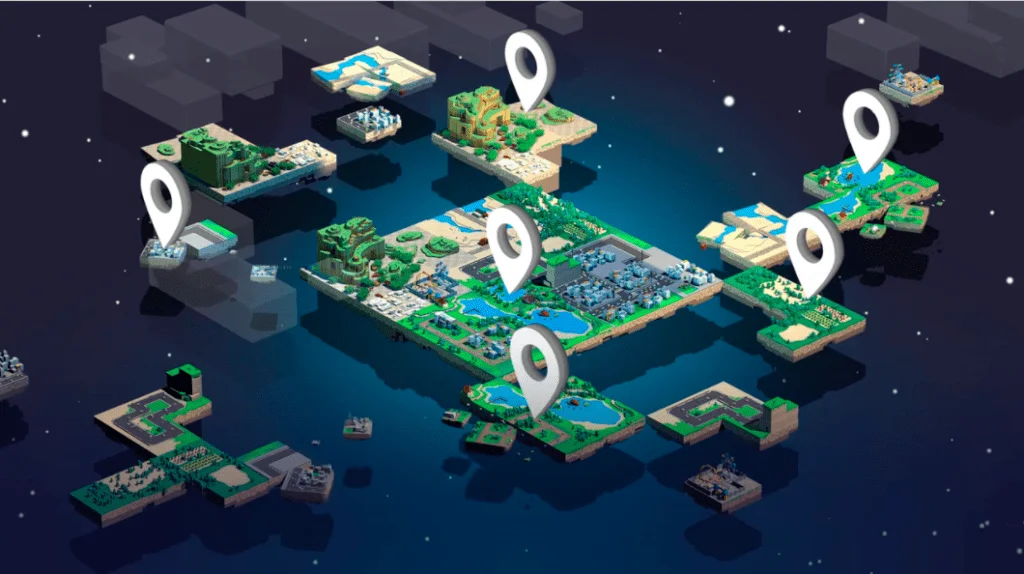

Land plots in NFT-centric games become the most valuable sort of digital asset in 2021. Virtual metaverses such as Axie Infinity, Decentraland, The Sandbox, and others have built virtual metaverses where a single land plot can cost thousands of dollars.

This year has also seen a number of spectacular rallies of metaverse protocols’ fundamental native currency.

Even as cryptocurrency values continue to fall, metaverse tokens perform well: MANA token is practically the only token in the top 100 that is up double digits today.

Today, MANA is up 12%, while AXS is up 3.8 percent in the last 24 hours. Overnight, SAND in the Sandbox increased by 7%.