Bitcoin (BTC) and Ethereum (ETH), the two largest cryptocurrencies by market capitalization, have been influencing the performance of other crypto assets, such as Shiba Inu (SHIB).

Shiba Inu Has A Stronger Correlation With ETH Than BTC

For example, the price of Shiba Inu has decreased by 2.3% in the past 24 hours, reaching $0.00001294. In the same timeframe, Bitcoin and Ethereum have also experienced declines of 2.93% and 2.54%, respectively.

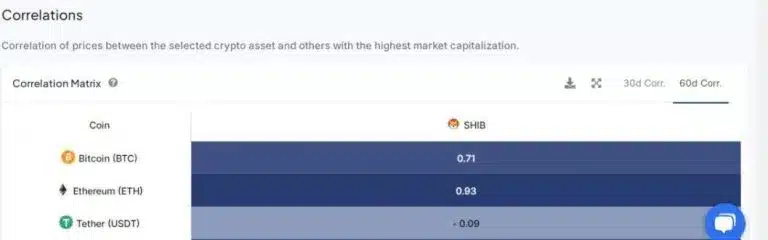

Shiba Inu is more closely associated with Ethereum than Bitcoin, according to data from blockchain analytics platform IntoTheBlock (ITB). Shiba Inu has a 93% correlation with Ethereum’s price over the past 60 days, as per ITB. Nevertheless, the dog-themed token’s correlation with Bitcoin during the same period is 71%.

This implies that the price of Shiba Inu has been more significantly influenced by Ethereum’s performance over the past 60 days. To the extent that Shiba Inu maintains this correlation, its price will experience a surge whenever Ethereum experiences an increase, and the reverse is also true.

The price of a Shiba Inu is as follows in the event that Ethereum reaches $166,000:

We conducted an analysis of several prominent ETH predictions and their potential influence on the price of Shiba Inu in response to the recent decline in the crypto market.

We focused in particular on Cathie Wood, CEO of ARK Invest, who predicted that the price of ETH could reach $166,000 by 2032.

Cathie predicts that ETH will reach a market capitalization of $20 trillion by 2032, which is approximately eight years from now. The second-largest cryptocurrency by market capitalization, Ethereum (ETH), must experience a 7,167% increase from its current price of $2,284 in order to achieve this objective.

Consequently, the price of Shiba Inu would rise to $0.00094035, provided that the circulating supply of SHIB remains relatively stable at 583.45 trillion, if it experiences a comparable growth rate of 7,167%. In this hypothetical situation, the market capitalization of Shiba Inu will increase from $7.62 trillion to a staggering $554.29 trillion.

It is important to note that this analysis is intended for informational purposes. Therefore, it should not be construed as financial advice, as there is no assurance that SHIB will achieve this objective in the near future.