Binance’s diminishing USDC reserves have become a hot topic in the crypto ecosystem, especially following Coinbase’s CEO’s remark.

Binance published its most recent proof-of-reserves (PoR) on August 1, providing transparency into its crypto reserves. However, the movement of its USDC reserves during the collapse of Silvergte drew widespread attention and became a topic of discussion on X.

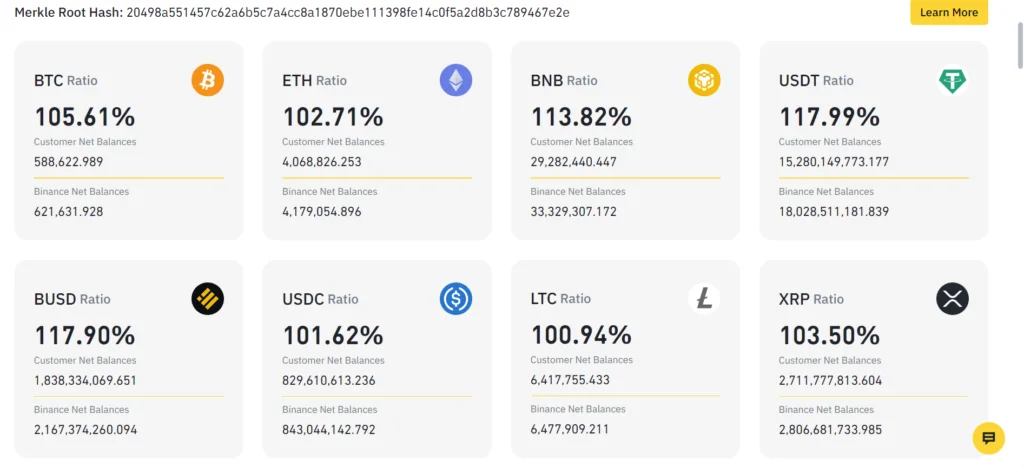

The most recent reserve audit indicates that Binance possesses more crypto and cash than is required to cover user funds. As shown below, the ratio of Binance’s net balances to its customers’ net balances is more significant than 100 percent for all its assets.

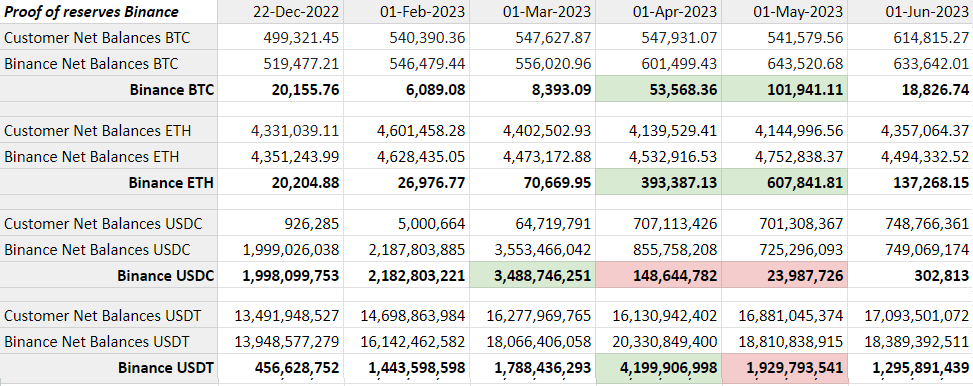

While the report indicates that Binance is in a healthy financial position, its USDC reserve movements following the Silvergate hack and the depeg of the stablecoin were the primary topic of discussion. The Proof of Reserves demonstrates that Binance’s USDC balance fell from $3.4 billion on March 1 to $23.9 million on May 1.

Internally, Binance began converting USDC to BUSD in September, but it also held a significant quantity of USDC in reserves at the time. After Silvergate’s collapse on March 12, according to on-chain data, Binance began converting its USDC reserves into Bitcoin.

Twitter on-chain analyst, Aleksandar Djakovic observed that Binance purchased approximately $3.5 billion worth of BTC and ETH between March 12 and May 1, the same amount as their USDC surplus.

Binance’s USDC reserves have become a heated topic after Coinbase CEO Brian Armstrong joked on the company’s Q2 earnings call that Binance had sold USDC for another stablecoin.

After the demise of the FTX cryptocurrency exchange, PoR became a popular method for crypto exchanges to attest their holdings and share them with the public as a means of transparency. After FTX was incapacitated in November 2022, despite its founders’ claims that its financial situation was well-balanced, the crypto ecosystem demanded greater transparency.