In the past 24 hours, Solana dApps based have achieved unprecedented revenue and fee activity, seemingly due to the resurgence of memecoin surge.

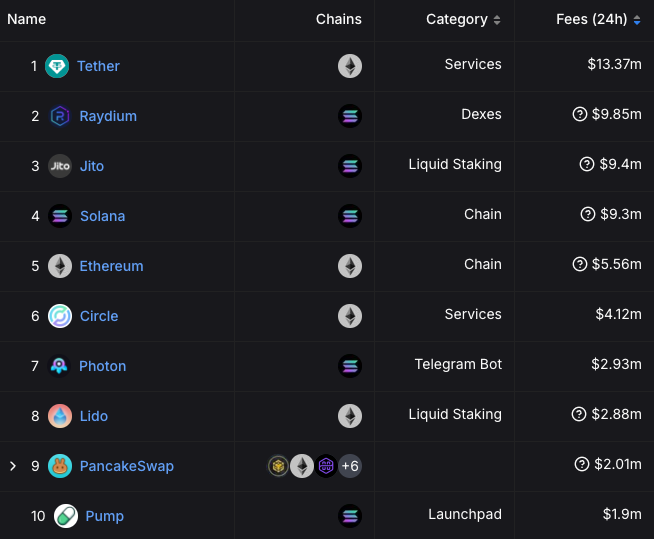

Five out of the top ten protocols by fees in the last 24 hours were on Solana, according to a November 18 X post from decentralized finance commentator Patrick Scott, who cited DefiLlama data.

The liquid staking protocol Jito experienced its third-highest day of fees on November 17, with a total of $9.87 million, according to DefiLlama data. Raydium, an automated market maker based in Solana, registered a record $11.31 million in fees on the same day.

Pump.fun, the memecoin launchpad, experienced its seventh-highest day of revenues, generating $1.65 million in fees.

The seventh highest-earning product was Photon, a Telegram trading program for Solana memecoins. It generated its fifth-highest day of fees on record, earning $2.36 million.

The native Solana token has experienced a significant price increase, reaching $242, its most incredible level since November 2021, and a flurry of speculation regarding memecoins. In response, the fees for several Solana protocols have reached record levels.

Peanut (PNUT), a memecoin named after a squirrel, experienced a 2700% increase over the past fortnight, reaching its highest value of $2.4 billion on November 14. This happened with the Department of Government Efficiency’s launch on X. Elon Musk shilled the token on X multiple times.

On November 15, the United States crypto exchange Coinbase listed the largest Solana memecoin, Dogwifhat, briefly reaching a six-month peak of $4.19.

Under President-elect Donald Trump, the Department of Government Efficiency is a new United States government agency that shares the same abbreviated name as the memecoin Dogecoin (DOGE) ticker. DOGE has also experienced a substantial increase in value over the past seven days, exceeding 140% in the past two weeks.

Despite supply inflation, Solana surpasses $240

SOL is currently trading at $234, a mere 8.5% movement from reclaiming its all-time high price of $259.

It is worth noting that Solana’s market capitalization has increased by 44% to $112 billion from $77 billion at its previous all-time high on November 6, 2021.

The market capitalization has increased due to the general increase in Solana tokens issued as part of its inflation schedule. This schedule incentivizes stakeholders to earn newly minted SOL tokens in exchange for their contributions.

Per SolanaCompass data, Solana’s inflation rate is 4.9% at the time of publication and is decreasing at 15% annually.