Investment portfolios in South Korea remain modest, with 67% of investors holding less than 500,000 won ($362) in crypto assets.

During this time period, South Korean cryptocurrency investors witnessed a substantial rise, which coincided with the profitability of the digital asset exchanges in the country. There were 7.78 million cryptocurrency investors in South Korea during the first half of 2024, which is an increase of more than 21% compared to the second half of 2023, when there were 645 million investors in digital assets in the country.

As a result of the increasing number of investors, the cumulative operating profits of the top 21 local centralized exchanges (CEXs) have reached over 5,900 billion won, which is equivalent to $4.2 billion.

The country’s Financial Services Commission’s results, shared in local media outlets, indicate a year-over-year (YoY) increase of more than 106%. An increase in the number of retail investors is a positive indicator that a bull market is on the horizon.

This is because the newly acquired capital will contribute to the ongoing price appreciation of the most prominent cryptocurrencies, such as Bitcoin and Ethereum. With the upcoming presidential elections in the United States, Bitcoin came dangerously close to reaching a new all-time high.

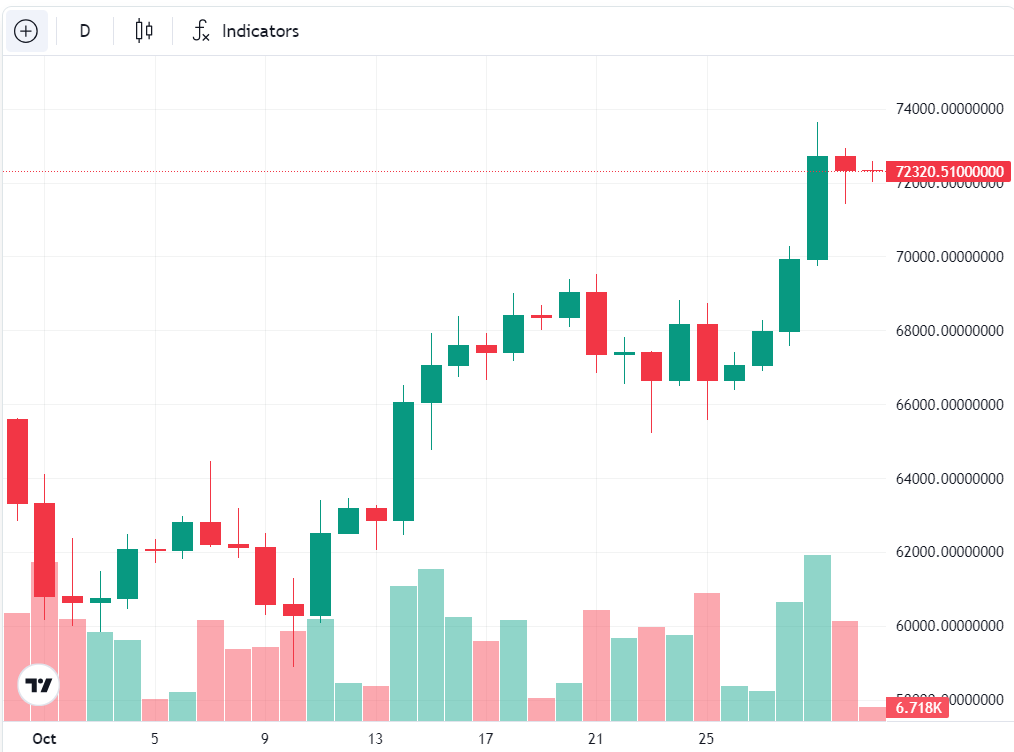

When Bitcoin (BTC) reached a new high of $73,600 on October 29, it was just $200 short from reaching a new record high. This was the highest amount it had reached since March 2024.

Nevertheless, there are analysts who are of the opinion that the current price behavior of Bitcoin is a “Trump hedge” because it does not possess the basic macroeconomic circumstances that would propel the world’s first cryptocurrency to a new all-time high.

South Korean crypto investors’ average portfolio is below $400

In South Korea, males make up more than 68% of all cryptocurrency investors, with males over the age of 30 constituting the largest category of investors, accounting for 1.58 million of the country’s total investors.

There are also 1.5 million male investors in South Korea who are over the age of 40, 108 million male investors who are over the age of 20, and only 850,000 male investors who are over the age of 50.

However, the typical proportion of cryptocurrency held by South Korean investors continues to be quite low. Over 528 million investors, or 67% of all investors, had a portfolio worth less than 500,000 won, which is equivalent to $362 worth of cryptocurrencies.

Conversely, only 10%, or 780,000 South Korean investors, possessed over 10 million won or $7,254 worth of digital assets, while only the top 1.3%, or 100,000 investors, held over 10 billion won or $7.25 in digital assets.

Looking at the greatest holding of South Korean investors, over 37% was in Bitcoin, 11% in Ether, 10.6% in the XRP, 2.8% in Dogecoin, and 2.7% invested in Ethereum Classic.