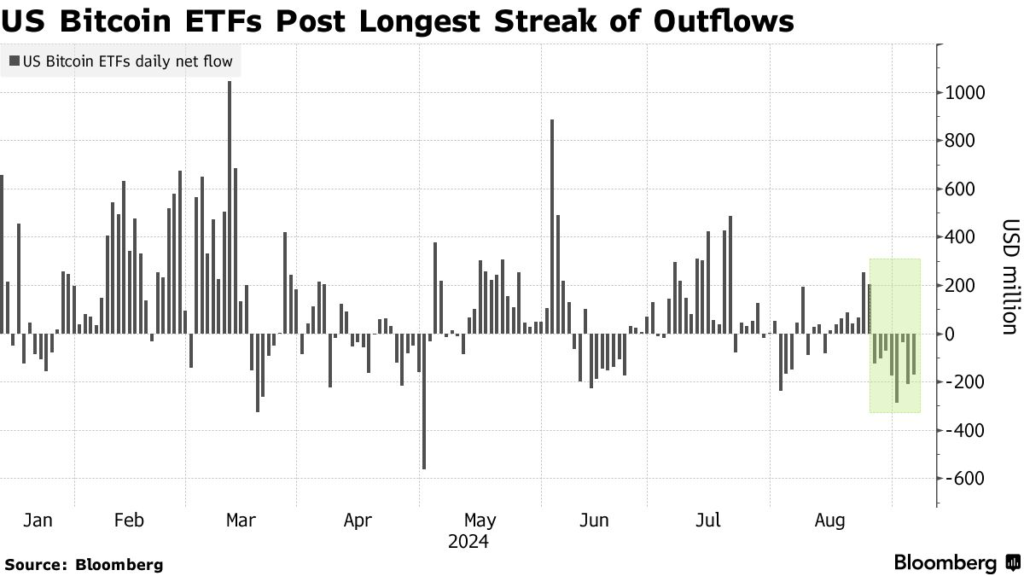

In eight days, the 12-spot Bitcoin exchange-traded funds (ETFs) in the United States experienced a combined net outflow of $1.2 billion.

Bloomberg data from September 9 indicated that investors withdrew approximately $1.2 billion from the 12 Bitcoin ETFs listed on the spot market between August 30 and September 6. Since their listing in January, this represents the longest net outflow stretch for the ETFs.

This occurred during the initial week of September, during which Bitcoin prices experienced a decline from a peak of $64,668 on August 26 to a low of $53,491 on September 7. This is a 17.28% decrease in a mere two weeks. Nevertheless, analysts contend that BTC has historically demonstrated subpar performance in September.

BTC prices Decline is reminiscent of a typical “Rektember”

Cryptocurrency enthusiasts frequently employ the terms “Rektember” and “Uptober,” as digital asset prices “rekt” in September and “get some relief” in October.

Bitcoin experienced a two-week nadir at the commencement of September 2024, losing over 2%. Nevertheless, according to analysts, the digital asset has the potential for significant growth.

Suze Orman, a financial adviser, maintains that Bitcoin has the potential to impact the future of cryptocurrency despite its short-term fluctuations.

Orman stated in a CNBC interview that the asset’s price will increase as younger individuals accumulate more wealth and invest in BTC.

Crypto is the primary focus of 2024 ETF launches

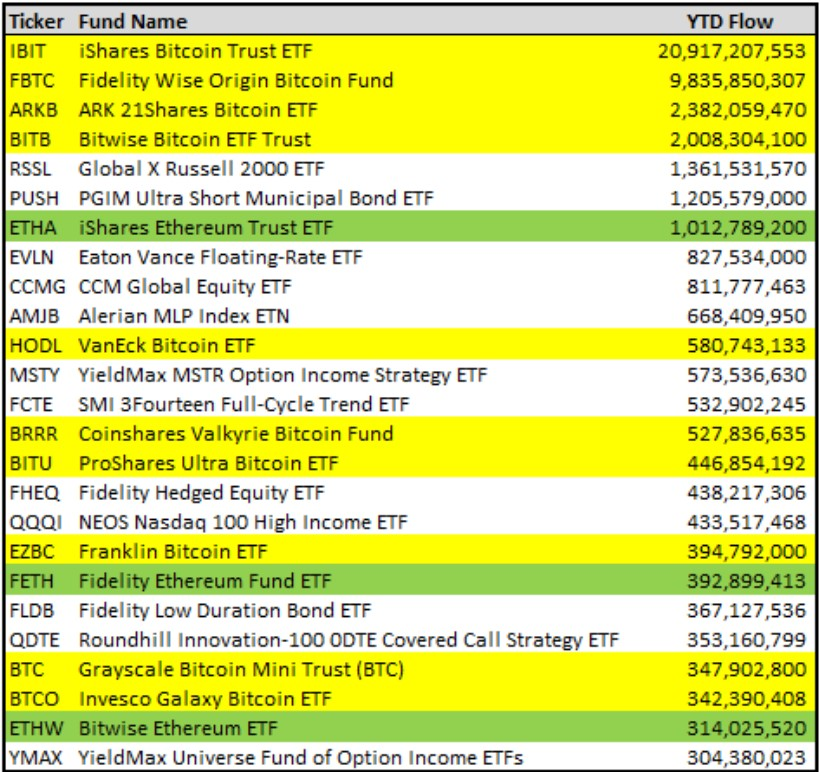

In contrast to the 400 new ETFs introduced in 2024, crypto remained the dominant asset class in the ETF space despite the outflows. The four largest launches in 2024 are all spot Bitcoin ETFs, according to data from The ETF Store.

This encompasses the ARK 21Shares Bitcoin ETF (ARKB), the Bitcoin ETF Trust (BITB), Fidelity’s Wise Origin Bitcoin Fund (FBTC), and BlackRock’s iShares Bitcoin Trust (IBIT).

13 of the top 25 ETF launches by inflows are associated with cryptocurrency. Ten of the ETFs are Bitcoin-based, while three are Ethereum-related securities. The iShares Ethereum Trust ETF (ETHA) was the seventh-largest ETF launch in 2024, surpassing the $1 billion threshold in August among the Ethereum ETFs.