On August 20, State Street, a financial services and asset management firm with $4.4 million in assets under management, disclosed its intention to establish a digital asset platform for institutional clients.

In partnership with Taurus, a digital asset infrastructure provider, the platform will provide institutional clients with tokenisation services, node administration, and custodial services. Lamine Brahimi, the co-founder and managing partner of Taurus SA, disclosed to Cointelegraph after the announcement:

“We believe custody and tokenization are the two faces of the same coin, especially when performing asset servicing of tokenized securities.”

The firm will be able to simplify the process of servicing and issuing digital assets, such as “digital securities and fund management vehicles,” by utilising Taurus’ Taurus-PROTECT, Taurus-CAPITAL, and Taurus-EXPLORER products, as per State Street.

Institutions that are adopting digital assets

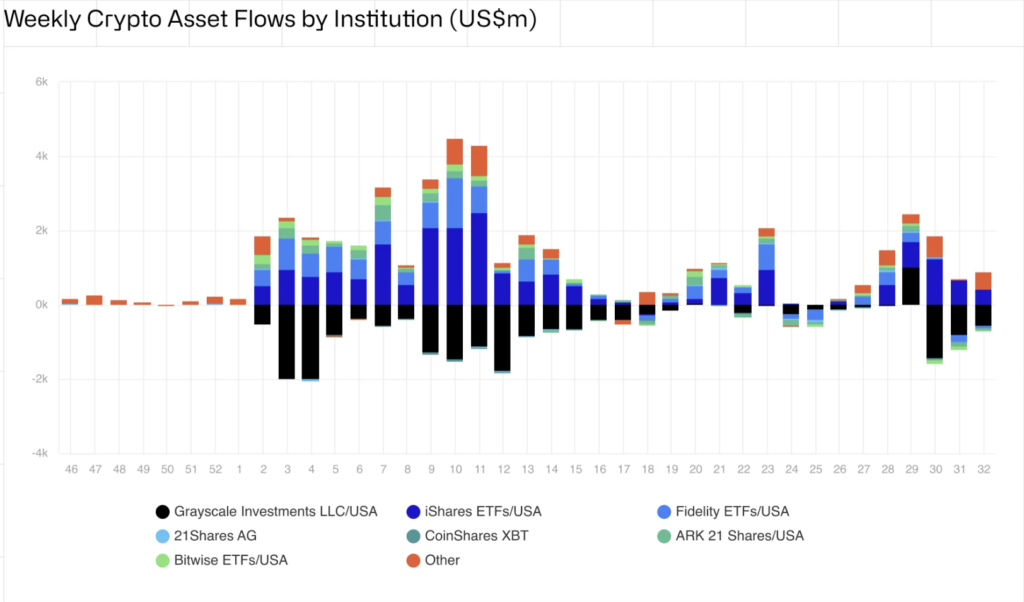

Institutional interest in digital assets and digital asset investment vehicles increased significantly following the introduction of BlackRock’s spot Bitcoin exchange-traded fund (ETFs) in the United States.

In the second quarter of 2024, 66% of institutional Bitcoin investors either maintained or increased their BTC holdings, according to recent data from Bitwise. To be more precise, 44% of those investors increased their exposure to the scarce digital asset, while 22% maintained their investments without accumulating additional BTC.

Sygnum Bank’s director of investment research, Katalin Tischhauser, recently informed Cointelegraph that the assets under the management of Ethereum ETFs could increase to $10 billion during the first year of live trading.

Additionally, an anonymous source informed Cointelegraph that Morgan Stanley had authorised its network of 15,000 advisers to suggest Bitcoin ETF alternatives to clients from August 7.

The source clarified that Morgan Stanley exclusively promoted BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC).

Despite the recent market volatility of the past week, inflows into Bitcoin ETFs remain robust, with an estimated $11 million streaming into the investment funds on August 15.