Bitcoin may face further negative pressure in the run-up to the September 18 US interest rate cut, but will it fall below $50,000 this weekend?

A Bitcoin correction below the crucial $50,000 mark could happen as early as this weekend, potentially increasing downward pressure in September, which is historically a bearish month for the cryptocurrency.

This weekend may bring more selling pressure for Bitcoin, as large holders, known as whales, aim to lock in profits. One notable whale address sold 100 BTC, worth over $5.3 million, securing a profit of $206,000.

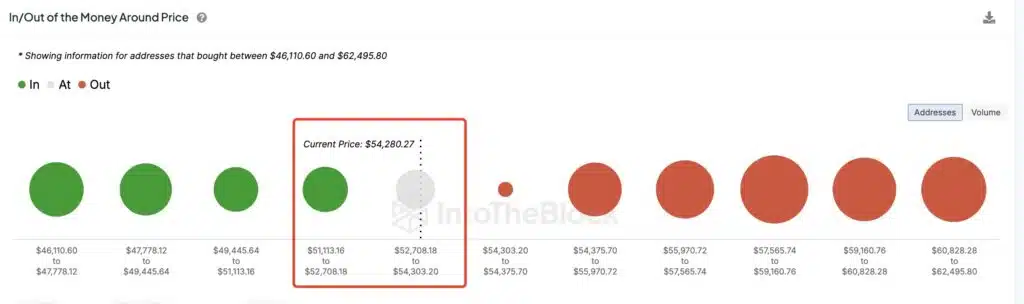

In a similar trend, approximately 402,000 BTC valued at over $21 billion were purchased by addresses likely looking to sell at breakeven, as per a September 7 post on X by on-chain analytics firm Lookonchain:

“836,000 addresses bought ~402,800 $BTC ($21B) at a price between $51,113 and $54,303. These addresses are likely to sell near the breakeven.”

Whales have the ability to heavily influence a cryptocurrency’s price movements due to their significant market holdings. Traders often monitor whale selling patterns to gauge short-term price trends.

Bitcoin Could Drop Below $50,000 — Arthur Hayes

Arthur Hayes, former CEO of BitMEX, warned that Bitcoin might dip below the critical $50,000 level by this weekend. In a September 6 X post, Hayes wrote:

“BTC is heavy, I’m gunning for sub $50k this weekend. I took a cheeky short. Pray for my soul, for I am a degen.”

At the same time, Bitcoin lost its support at $55,000, dropping 1.4% to trade at $54,340 in the 24 hours leading up to 9:26 am UTC on September 7. Over the past week, the cryptocurrency is down nearly 8%.

Analysts from Bitfinex cautioned about a possible correction below $50,000 before a real bullish rally begins. They told Cointelegraph:

“This is not an arbitrary number, but based on the fact that the cycle peak in terms of percentage return reduces by around 60%–70% each cycle, and the average bull market correction has reduced as well.”

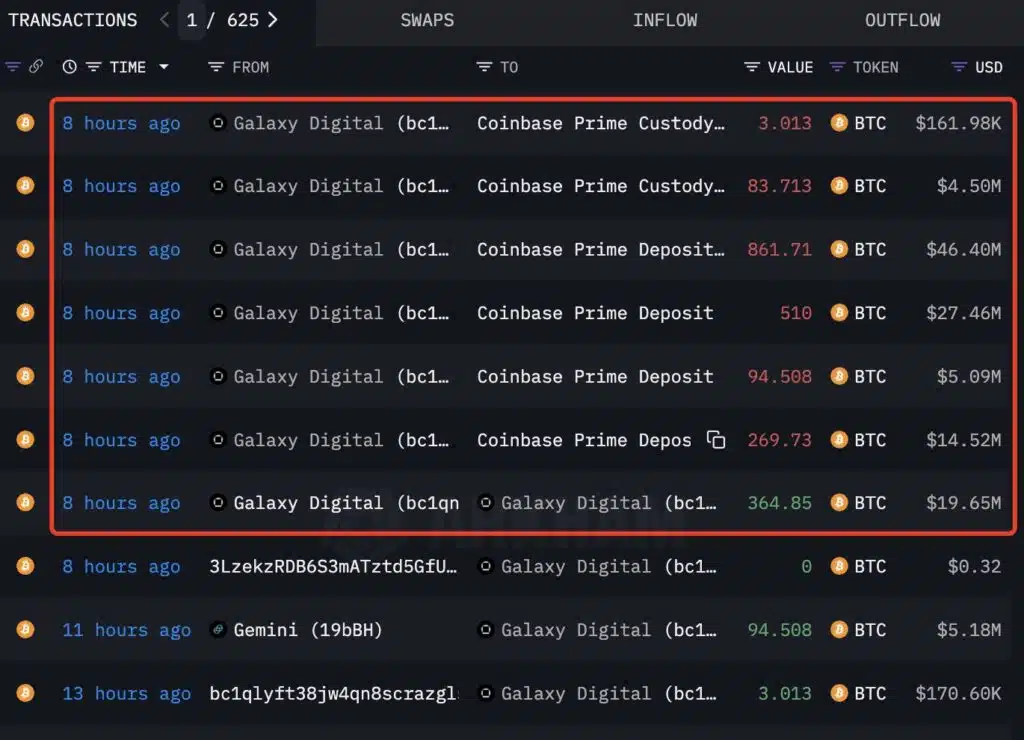

Adding to concerns, Galaxy Digital deposited $78.5 million worth of BTC into Coinbase Prime on September 7, as noted by Lookonchain.

Bitcoin Faces More Pressure Ahead of Interest Rate Cut

A potential interest rate cut in the U.S. could improve investor sentiment for assets like Bitcoin.

However, more downward pressure is expected before the Federal Reserve’s September 18 decision, according to Alvin Kan, chief operating officer of Bitget Wallet. He told Cointelegraph:

“We expect BTC and the equity markets to face downward pressure leading up to the Fed’s official rate cut announcement. Once the rate cut is confirmed after the September FOMC meeting, we may see a short- to mid-term boost in risk assets.”

Whale and institutional buying could also significantly affect Bitcoin’s short-term price movements. Kan added:

“Given the current market volatility, there’s a possibility of BTC experiencing liquidity issues, which could cause sharp, temporary price drops. At the moment, there’s about a 40% chance of BTC dipping below $50,000.”

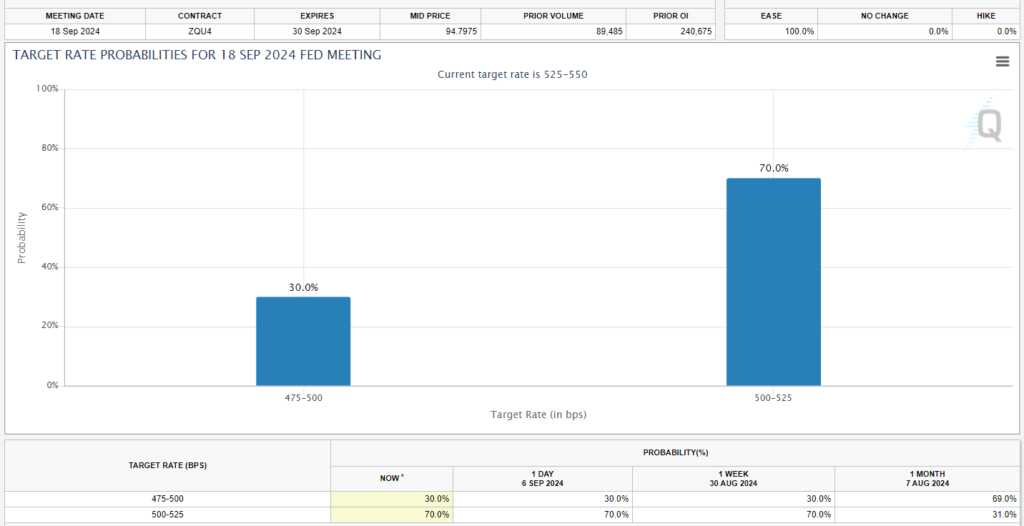

Investors increasingly anticipate a rate cut as the U.S. Federal Reserve’s September 18 meeting approaches.

The CME FedWatch tool shows a 70% likelihood of a 25 basis-point rate cut, while the chance of a 50 basis-point cut stands at 30%.