According to the results of a recent survey, the majority of Salvadorans still do not have a firm knowledge of Bitcoin or cryptocurrency.

El Salvador’s controversial introduction of Bitcoin as legal tender has garnered international attention. The move has sparked outrage among many local citizens and has been met with skepticism by the International Monetary Fund, which has expressed concern about the country’s financial stability.

According to the results of a recent survey, despite these advancements, the majority of El Salvadoreans still know little about the veteran cryptocurrency and much less about its smaller-market size peers.

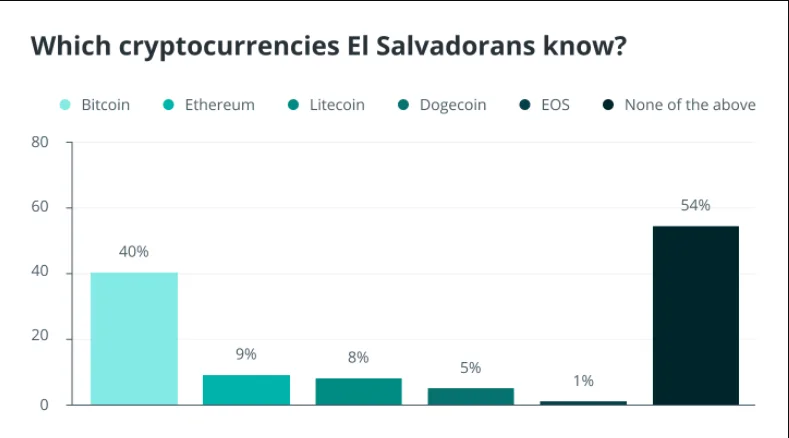

Respondents to a survey by the So Paulo-based advertising agency Sherlock Communications answered ‘none’ when asked which cryptocurrency they were most familiar with from a list of five popular coins, according to the results of the survey.

While 40 percent of respondents chose Bitcoin over the other listed cryptocurrencies – Ether (ETH), Bitcoin, Dogecoin (DOGE), and EOS – the survey did not attempt to determine the level or depth of knowledge these respondents had about the coin. Instead, it asked them to name their favourite cryptocurrency.

Patrick O’Neill, director of Sherlock Communications, responded to Cointelegraph’s inquiry with the following statement:

“The data we collected from El Salvador made it very clear to us that there are very high levels of confusion regarding cryptocurrency, surprisingly as this may seem, given the circumstance.”

This is supported by the responses to the survey’s other questions, with 46 percent of respondents selecting “none” when asked,

“What would give you the confidence to invest in cryptocurrencies?” 18 percent of respondents said that better regulation would assist them in making the transition, with a similar number (16 percent) stating that access to more reliable and user-friendly platforms would make a difference in their decision.

When asked whether or not a local economic crisis would make them more or less inclined to trust cryptocurrency, 35% said they would be “less likely,” and 28% said they would be “much less likely” to invest in the asset class if the economy were to tank.

About 24 percent of respondents were of the opposite opinion, stating that a downturn in the economy would increase their interest in cryptocurrency.

However, a larger number of respondents – 41% – stated that a negative economic situation would have no impact on their relationship with cryptocurrency.

While a majority of survey respondents (42 percent) expressed neither support nor opposition to the idea of Bitcoin being recognized as legal cash, they did not express outright hatred or enthusiasm for the idea.

Out of the remaining respondents, 31 percent expressed a more or less negative opinion of the move, while 29 percent expressed a more or less favourable opinion of the move.

Answers to a question about the state of cryptocurrency in the country, both now and in the future, were distinguished by neutrality or apathy once more. The majority of respondents (32 percent) expressed no view on the subject, with the next greatest proportion of responses identifying with the remark, “It’s a subject that has no future in this country.”

As reported in recent news coverage of people’ opposition to the government’s new Bitcoin regulation, one person stated that: “We don’t know anything about the currency.” We are baffled as to where it originates from. No one knows if it will result in a profit or a loss for us. “We don’t have any information.”