Tether, the operator of the largest stablecoin by market value, is reorganizing to establish new divisions outside stablecoin development.

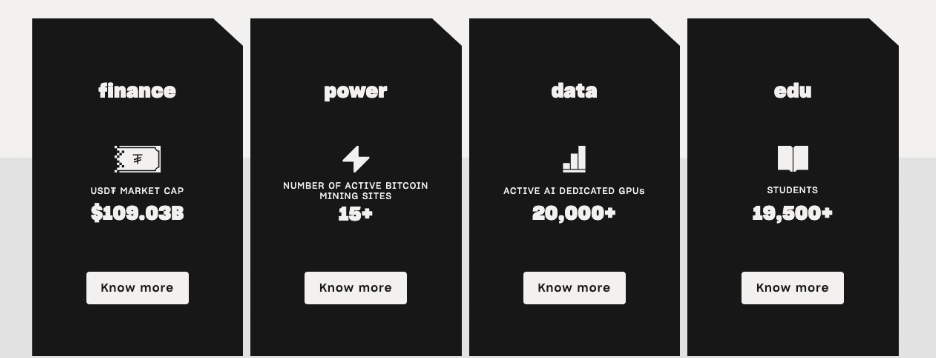

According to an official announcement on April 18, the stablecoin behemoth has introduced four new business divisions into its framework: Tether Data, Tether Finance, Tether Power, and Tether Edu.

Tether intends to expand its mission by establishing these new divisions to offer various new infrastructure solutions, investments, and services.

Tether Data will prioritize strategic investments in technologies such as Pear Runtime and Holepunch, as well as Keet and Pear Runtime, which are peer-to-peer platforms.

According to the announcement, Tether Finance aims to democratize the global financial system as the central repository for the company’s traditional stablecoin products and financial services.

Tether Edu will concentrate on digital education and promoting blockchain adoption on a regional and international scale. In contrast, Tether Power aims to advance Tether’s mining and energy initiatives.

“With the world’s first and most trusted stablecoin, we disrupted the traditional financial landscape,” Tether CEO Paolo Ardoino said, emphasizing that the company is now “daring to launch inclusive infrastructure solutions by dismantling traditional systems for fairness.”

He proceeded:

“With this evolution beyond our traditional stablecoin offerings, we are ready to build and support the invention and implementation of cutting-edge technology that removes the limitations of what’s possible in this world.”

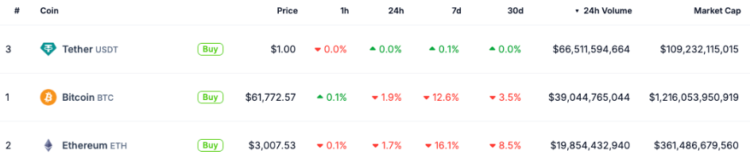

Tether administers USDT, the largest stablecoin by market capitalization and the largest cryptocurrency by trading volumes. Established in 2014, Tether is one of the largest companies in the cryptocurrency ecosystem.

Tether achieved a significant historical milestone in March 2024 when its market value surpassed $100 billion.

In addition to USDT, Tether manages an extensive portfolio of stablecoins, such as the EURT token anchored to the Euro, the CNH₯ offshore Chinese Yuan, and the XAUt gold-backed Tether Gold, among others.

Restructuring Tether represents another stride in the organization’s endeavor to transcend stablecoins. The company made a significant foray into the Bitcoin (BTC) mining sector in 2023, initiating its mining operations and distributing exclusive software.

Tether established an educational division in February 2024 to offer seminars, courses, and additional materials to foster the growth of expertise in blockchain technology and associated domains.

In addition to amassing Bitcoin, Tether acquired 8,888 BTC for $618 million at the end of March 2024. As of March 31, Tether had accumulated 75,354 Bitcoin, which it had acquired for an average of $30,305.