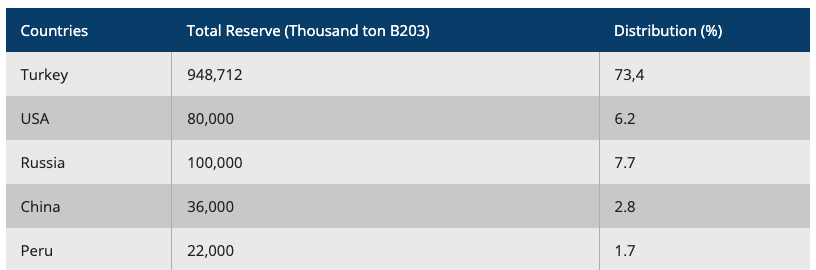

Turkey’s state-owned boron miner claims that the country holds more than 70% of the world’s borate reserves.

Tether, the company behind the world’s largest stablecoin by market capitalization, has reportedly proposed the creation of tokens representing borate minerals to the Turkish government.

On October 24, Bloomberg reported that Tether suggested Turkey adopt blockchain technology to create digital tokens backed by boron.

While a Turkish official mentioned that this proposal isn’t feasible at the moment, an Energy Ministry official confirmed that talks with Tether are still in the early stages.

The report also indicated that Tether brought up the possibility of establishing a digital asset exchange in Istanbul.

Turkey Controls Over 70% of Global Boron Supply

Borate minerals primarily produce ceramics, detergents, fertilizers, and glass. Turkey’s state-owned boron supplier, Eti Maden Isletmeleri Genel Mudurlugu, estimates that the country holds more than 70% of the world’s boron reserves.

The Turkish government projects that boron sales will generate around $1.3 billion in 2024.

Tether’s proposal for a boron-backed digital currency aligns with the broader cryptocurrency industry’s interest in tokenization, which uses blockchain technology to create representations of real-world assets (RWAs).

Tether’s Commitment to Crypto Innovation in Turkey

Although Tether neither confirmed nor denied the report to Cointelegraph, CEO Paolo Ardoino emphasized the company’s dedication to fostering innovation in Turkey’s digital asset space. He stated:

“With Turkey emerging as a key hub for blockchain technology, we’re excited to continue supporting this momentum and exploring new opportunities for growth in the region.”

Tether has been increasing its efforts to promote crypto adoption in Turkey. The company’s local expansion manager, Anadolu Aydinli, has met with several Turkish government officials in recent months.

In late September, Aydinli met with Turkey’s Vice President, Cevdet Yılmaz, to discuss energy and mining regulations.

Aydinli remarked:

“As we continue our work to create a flourishing environment for growth in our country, it is always a valuable milestone to have the support of our most senior governmental officials.”

In August, Aydinli also met with Energy Minister Alparslan Bayraktar to discuss energy sector investments in Turkey.

Additionally, in July 2024, Tether signed an agreement with a local crypto firm to explore initiatives that involve private and public stakeholders in the country.

Turkey: A Major Market for Stablecoins

Tether’s focus on crypto adoption in Turkey aligns with Ardoino’s earlier statements that the country is one of the largest markets globally for stablecoins.

He explained that people in Turkey and similar nations seek to hold a digital version of the U.S. dollar to protect against currency volatility and inflation.

“Our focus has to be where we are needed the most,” Ardoino told Cointelegraph in early October.

According to data from blockchain analytics firm Chainalysis, Turkey had the highest proportion of stablecoin purchases relative to its GDP from April 2023 to March 2024.

Stablecoin transactions accounted for 4.3% of Turkey’s GDP, making it the world’s largest buyer of stablecoins in proportion to its economic output.