Tether, the issuer of the largest stablecoin USDT, has revealed its massive exposure to US Treasury bills, surpassing many countries. This comes amid a market crash that saw USDT lose its peg briefly.

Tether, the company behind the most popular stablecoin USDT, has announced that it holds $72.5 billion worth of US Treasury bills, making it one of the top buyers globally.

According to a tweet by Paolo Ardoino, CTO of Tether, this puts Tether in the global top 22, above nations like the United Arab Emirates, Mexico, Australia, and Spain.

Ardoino claimed that this development shows the growing importance of USDT in emerging markets, providing a lifeline for communities facing high inflation in their local currencies.

He also contrasted Tether’s increasing demand for US debt with China’s decreasing appetite, as the latter reportedly shifts its focus to gold.

The news comes at a time when Tether faced a market turmoil that affected its stability.

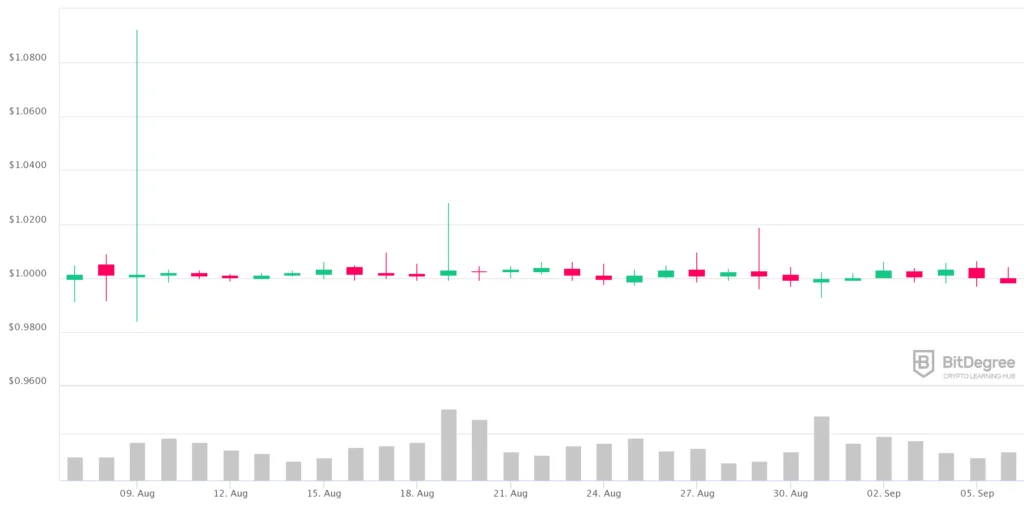

On Aug. 17, USDT deviated from its $1 peg, dropping as low as $0.99 amid a market downturn that wiped nearly $100 billion from the crypto market.

Despite this brief instability, Tether remains the dominant stablecoin by market cap, controlling over 60% of the market.

USDT also recovered quickly, with its trading volume exceeding $50 billion in the past 24 hours, six times higher than its closest competitor, USD Coin (USDC).

However, some crypto traders preferred other stablecoins besides USDT during the market chaos, especially DAI and USDC.

Data from 3Pool’s dashboard—Curve’s largest liquidity pool—showed that USDT accounted for nearly 50% of the reserve, while USDC and DAI made up the balance.

This indicates a possible trend among traders who sought refuge from the market volatility by selling USDT for DAI and USDC.