Tether’s earnings were driven by demand for USDT and returns from U.S. Treasury bonds.

The stablecoin issuer Tether has produced another quarter of record-breaking earnings, reporting a total of $2.5 billion in profits for the third quarter of 2024.

The attestation report from October of this year estimates the company’s consolidated profit in 2024 to be $7.7 billion, with equity totaling $14.2 billion and total assets totaling $134.4 billion.

The driving forces behind the findings are both the demand for its stablecoin, Tether, and the yields on US Treasury bonds, which back its reserves. This year saw the release of an additional $27.8 billion worth of tokens, increasing the total amount of USDT in circulation to $120 billion.

This represents a nearly thirty percent increase in the circulation of USDT in 2024. Tether currently holds cash and cash equivalents worth over 105 billion dollars. The majority of these funds are in the form of United States Treasury notes, which are equivalent to $102.5 billion.

When compared to its portfolio of US Treasury securities, which was valued at $97.6 billion in July, this implies a 5% rise.In terms of its stockpile of US debt, Tether ranks among the top 18 global holders, surpassing Germany, Australia, and the United Arab Emirates.

Tether claims that its reserves have increased to more than $6 billion in 2024, which is a 15% gain over the course of the 9 months that have passed. The token issuance resulted in a total of approximately $119 billion in liabilities, while its reserves held assets totaling close to $125 billion.

For making false statements about the stability of its stablecoin backing, the United States Commodities and Futures Trading Commission (CFTC) levied a civil monetary penalty of $41 million against the firm in the year 2021.

Additionally, it achieved a settlement with the Office of the New York Attorney General for the amount of $18.5 million on the same or similar grounds. Another factor that contributed to the company’s favorable results during the quarter was the success of its gold assets, which reportedly generated nearly $1.1 billion in unrealized gains in the third quarter.

At the time of writing, Tether possesses an additional 7,100 Bitcoin, valued at close to $500 million. Additionally, it has a portfolio of businesses that it has invested in across a variety of industries, including renewable energy, Bitcoin mining, artificial intelligence, telecommunications, and education.

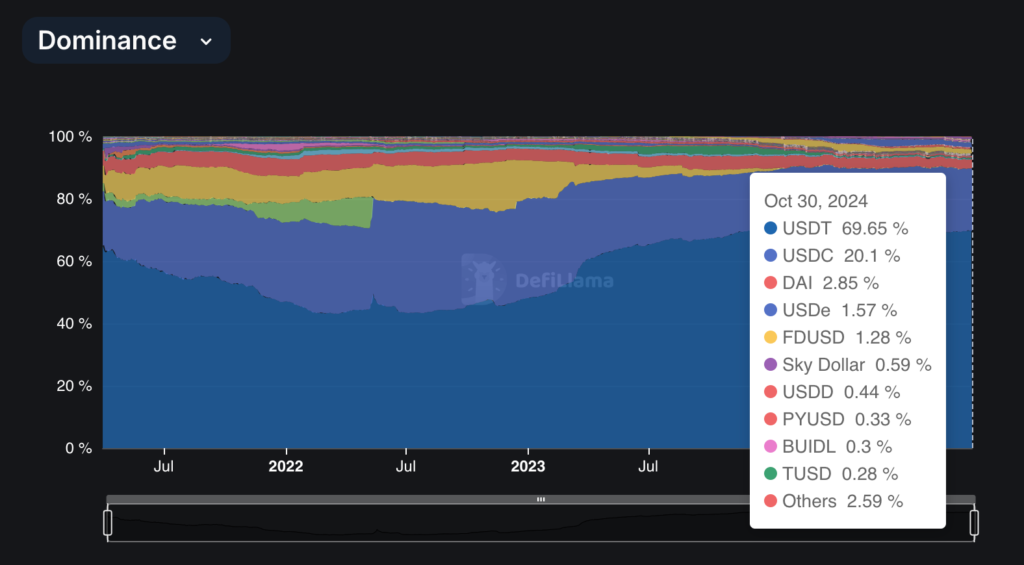

Tether has recently completed ten years as a corporation, and it has had tremendous market share growth over the previous two years. The implementation of increased governmental control in the United States following the collapse of FTX in November 2022 has contributed to this growth. In 2023, the company improved its partnership with US authorities by granting the Federal Bureau of Investigation (FBI) access to its platform.