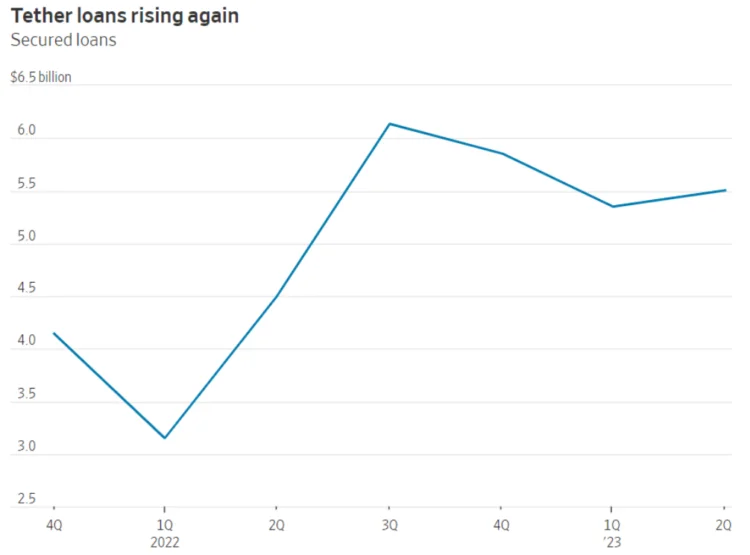

Tether, the largest stablecoin issuer in the cryptocurrency market, has seen an increase in its stablecoin lending, or secured loans, in 2023, despite its plans to cut it down to zero by 2024

According to Tether’s most recent quarterly report, its assets included $5.5 billion in loans as of June 30, up from $5.3 billion in the previous quarter.

A spokesperson for Tether told The Wall Street Journal (WSJ) that the recent increase in stablecoin lending was due to a small number of short-term loan requests from clients with whom the company has “cultivated longstanding relationships.” The spokesperson added that the company intends to eliminate such loans by 2024.

Tether’s stablecoin loans had become a popular lending product, allowing consumers to borrow USDT from Tether in exchange for collateral. However, these secured loans were always controversial due to a need for more transparency regarding the collateral and the consumers.

A report from the WSJ in December 2022 raised concerns about the products and asserted that the loans were not adequately secured. In times of crisis, the WSJ questioned Tether’s ability to satisfy redemption requirements.

In 2022, Tether addressed the controversies before announcing 2023 its intention to eliminate secured loans. The stablecoin issuer at the time referred to concerns regarding secured loans as “FUD” and claimed the loans were overcollateralized.

The recent increase in secured loans for Tether coincides with the company’s expanding market dominance and profitability. Tether reported $ 3.3 billion in surplus reserves in September, up from $250 million in 2022.

However, Tether responded to the WSJ article asserting that the publication’s concerns regarding stablecoin loans are unwarranted.

Tether added that as a company with $3.3 billion in excess equity and “on track to earn $4 billion in annual profits,” it effectively offsets the secured loans and retains such profits within its balance sheet. Tether remains dedicated to eliminating the secured loans from its reserves.”