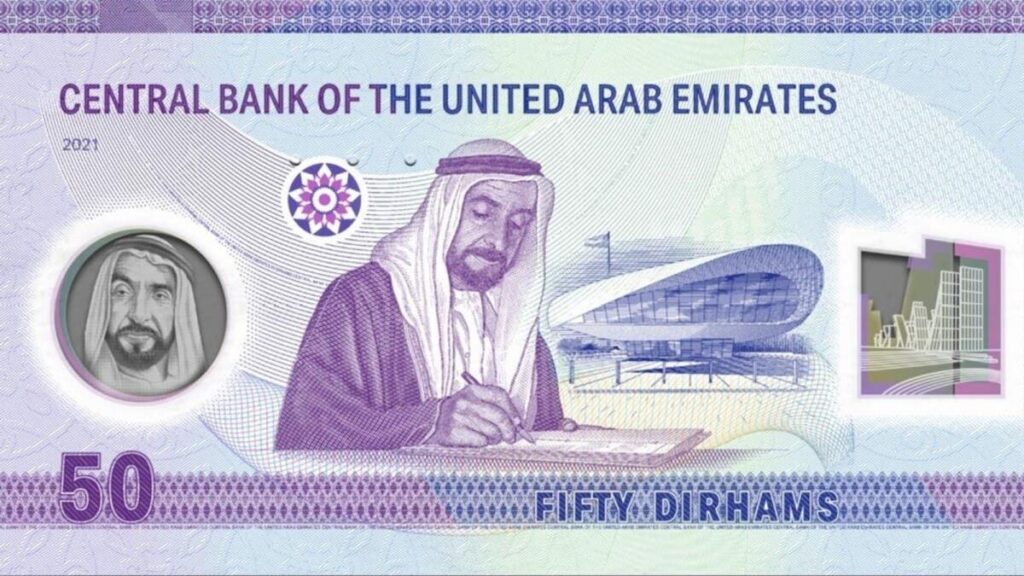

Tether, a significant stablecoin provider in the digital asset industry, has disclosed its intention to introduce a new stablecoin linked to the United Arab Emirates dirham (AED).

Phoenix Group PLC and Green Acorn Investments Ltd., based in the United Arab Emirates, sponsor the new stablecoin, as indicated in the press release disclosed to Cointelegraph.

The partnership aims to create a digital representation of the Dirham “completely backed by liquid UAE-based reserves.”

“Adhering to Tether’s transparent and robust reserve standards, it ensures that every Dirham-pegged token is tied to the value of the AED, providing stability and confidence in its value.”

Tether’s expansion into UAE markets

We anticipate that Tether’s new dirham-pegged stablecoin will offer consumers a cost-effective means of “accessing the benefits of the AED” as it expands into the UAE financial market.

The press release asserts that the new stablecoin will “simplify international trade and remittances” while hedging against currency fluctuations and reducing transaction fees.

Tether’s CEO, Paolo Ardoino, expressed satisfaction with adding the Dirham-pegged stablecoin to the company’s “range of stablecoin options.”

“The [UAE] is becoming a significant global economic hub, and we believe our users will find our Dirham-pegged token to be a valuable and versatile addition.”

Phoenix Group collaboration

Tether aims to furnish businesses and individuals with “an indispensable instrument” for conducting transactions in collaboration with Phoenix Group PLC, a multibillion-dollar technology conglomerate headquartered in Abu Dhabi.

As per the press release, the UAE has experienced an exponential increase in cryptocurrency usage since 2022, “driven by the establishment of the Virtual Asset Regulatory Authority.”

The partnership “reflects” the firm’s “dedication to providing financial solutions” to its clients, according to Seyed Mohammad Alizadehfard, co-founder and Group CEO of Phoenix Group.

Tether’s expansion on Aptos blockchain

Tether introduced USDT on the layer 1 Aptos blockchain on August 19th to reduce transaction costs and enhance global digital currency access and usage.

Tether aims to offer the blockchain’s consumers “extremely low petrol fees, costing only a fraction of a penny” by leveraging Aptos’ scalability and speed.

This integration will render transaction fees on Aptos using USDT “economically viable” for various use cases, such as large-scale enterprise operations and microtransactions.