According to crypto-journalist Colin Wu, the Hong Kong stock market plunge which triggered the global crypto market was caused by china’s second-largest real estate firm Evergrande.

The stock market in Hong Kong has crashed. The Hang Seng index in Hong Kong, in particular, fell about 7% on that day, hitting a 52-week low.

According to Colin Wu, the global crypto market’s massacre was prompted by the shares of Evergrande Real Estate Group plummeting by 10.24 percent.

Prior to that, the index had also dropped 17 percent. The Evergrande Real Estate Group is the second-largest property developer in China by sales, according to the Fortune Global 500 List for 2021. It is also the 122nd most profitable company in the world.

Henderson Land Development Co., another Hong Kong real estate behemoth, has also seen a significant stock sell-off.

Evergrande, according to Wu, owes about $2 trillion in debt. Concerns over one of the world’s leading real estate corporations’ debt crisis have impacted a wide range of markets, including bank stocks, high-yield dollar bonds, and Ping An Insurance Group Co. equities.

Bitcoin is expected to lose $312 million as a result of the announcement

As previously reported by U.Today, the flagship cryptocurrency has plummeted nearly 9% from its peak of $48,700 on Saturday to $44,436 earlier today.

In a single hour, the Bitcoin market saw a tremendous volume of liquidations worth $312 million. Nearly half of Bitcoin positions were liquidated on the Bybit exchange alone, totalling $153 million.

Multiple increases in BTC supply have been seen on crypto exchanges, which could lead to a further sell-off if Bitcoin continues to fall below the $45,000 support level. At the time of writing, the most popular digital currency was trading for $44,900 per coin.

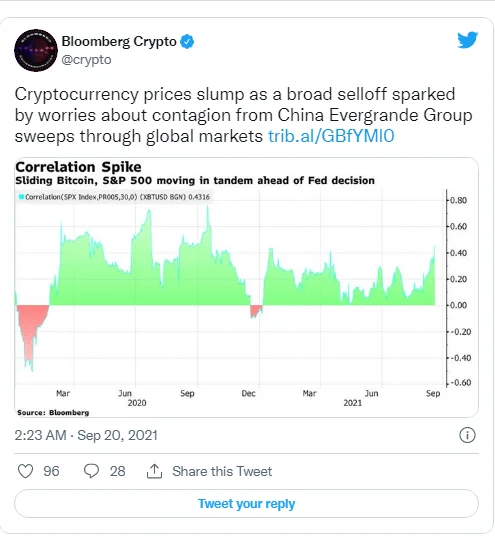

The cryptocurrency market is also down today, following the devastating news about Evergrande Real Estate Group.