Bitcoin’s (BTC) recent losses saw it fail a crucial test, where it was supposed to stabilize above $50k before the mid-halving correction event on April 11.

The token failed to pass a crucial $50,000 resistance level despite surging above the $48k level earlier this month.

If the token had strengthened, the cycle of price weakness stemmed from the halving of rewards of mining would have ended. But the token’s price dropped below the $42k level, increasing fears of another bear market.

Mid-Halving Moves Bitcoin (BTC) Price Lower

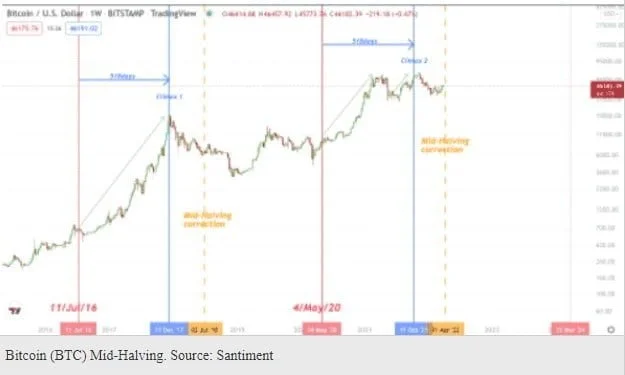

On-chain analytics platform Santiment announced last week that a large mid-halving correction event will take place on April 11. According to the Santiment analysis, it takes 515-545 days to reach an ATH after halving.

Bitcoin (BTC) price attained an ATH after 518 days and then went into a correction after dropping to break the important resistance level in the last two cycles. The BTC price enters into a long bear market following its mid-halving correction.

Santiment, on the other hand, believes the Bitcoin cycle will be different this time as the number of addresses was much higher around 900k, whales are accumulating Bitcoin, and investors are more mature.

Unfortunately, the current Bitcoin (BTC) price trend appears to be repeating past historical trends, as the price has dropped below $42k. Furthermore, Bitcoin is yet to stabilize above the $45k significant resistance level.

Thus, Bitcoin (BTC) price moving above $50k this week or month is unlikely. Therefore, the price is expected to break the next support level of $37k soon. And if the Bitcoin price does not rise above the $37k level, it will enter a bear market.

Other Factors Putting Pressure on Bitcoin’s (BTC) Price

The price of Bitcoin (BTC) has dropped about 10% in the last week, and nearly 3% in the last 24 hours, according to CoinMarketCap. The price action has moved in a downward direction from the $47k level, and it is now trading at $42,244.

Moreover, the upcoming Fed interest rate hike amid rising inflation and the crypto market correlation with the Nasdaq 100 index, has put downward pressure on Bitcoin’s price. Both fell briefly below their 50-day moving average today.