Over the last 24 hours, DGovernance tokens behind top decentralised exchanges Uniswap, SushiSwap, and 1inch Exchange have all seen significant gains, while tokens of the DeFi Exchange have increased by more than 10% on Ethereum.

DEXes, or decentralised exchanges, are essential components of the cryptocurrency sector. They do away with the middlemen that centralised exchanges like Coinbase and Binance rely on.

Several governance tokens traded on the top DEXes are currently experiencing large price rises.

The native token of Uniswap, UNI, is presently trading at $29.22, up 10.4 percent since press time.

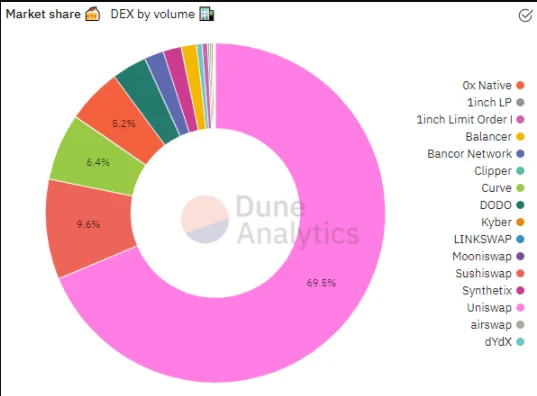

Uniswap was founded in 2017 and allows users to trade any ERC-20 token for a minimal fee. Users can also earn passive interest on their idle assets by adding them to the protocol and enhancing the liquidity of a trading pair. It is the most dominating DEX on the market at the time of writing, with approximately 70% market share.

Furthermore, according to CoinGecko, the platform is processing trading volumes on par with centralised counterparts in FTX Exchange and Kraken over the last 24 hours.

SUSHI, SushiSwap’s native token, is presently trading at $10.33, up 10.4 percent.

SushiSwap, a near-identical fork of Uniswap, has lately added a number of additional capabilities to the platform.

The four new products, which have been branded as “Trident,” continue to borrow ideas from previous decentralised finance (DeFi) systems.

Its ConstantProductPool is similar to Uniswap’s 50/50 token pool, in which liquidity providers are required to stake both sides of a trading pair. Curve Finance’s optimization for trading assets with comparable values, such as stablecoins, is imitated by the HybridPool.

The ConcentratedLiquidityPool is based on Uniswap’s v3 launch, which allows liquidity providers to choose the trading range in which they want to concentrate their liquidity. Finally, similar to Balancer, the WeightedPool allows users to manually modify the balance of pooled tokens.

The SushiSwap team has also been hard at work on its Shoyu non-fungible token (NFT) platform.

🍣 Here’s a sneak peek of Shoyu: @SushiSwap‘s NFT Platform

– Immersive Gallery & 3D Metaverse

– Social Token

– On-chain & off-chain exchange

– Bidding strategies

– Royalties distribution

– Fractional ownership

– Multi-chain supporthttps://t.co/decVPlEKRz

— LΞVX (@LevxApp) July 8, 2021

Furthermore, according to CoinGecko, the platform is processing trading volumes on par with centralised counterparts in FTX Exchange and Kraken over the last 24 hours.

SUSHI, SushiSwap’s native token, is presently trading at $10.33, up 10.4 percent.

SushiSwap, a near-identical fork of Uniswap, has lately added a number of additional capabilities to the platform.

The four new products, which have been branded as “Trident,” continue to borrow ideas from previous decentralised finance (DeFi) systems.

Its ConstantProductPool is similar to Uniswap’s 50/50 token pool, in which liquidity providers are required to stake both sides of a trading pair. Curve Finance’s optimization for trading assets with comparable values, such as stablecoins, is imitated by the HybridPool.

The ConcentratedLiquidityPool is based on Uniswap’s v3 launch, which allows liquidity providers to choose the trading range in which they want to concentrate their liquidity. Finally, similar to Balancer, the WeightedPool allows users to manually modify the balance of pooled tokens.

The SushiSwap team has also been hard at work on its Shoyu non-fungible token (NFT) platform.

1/

🚨 #Attention! The London hard fork activated EIP-1159, which dramatically changed the #Ethereum gas fee model.

As a result, the #1inch Foundation decided to adjust gas refund requirements.#ETH #DeFi #crypto https://t.co/ZIfDk7oFKC

— 1inch Network (@1inch) August 7, 2021

The factors that have contributed to each token’s recent growth are several. The underlying protocol on which they are all based, Ethereum, is the one thing that they all have in common.

As a result of the Ethereum hard fork that occurred last week, it appears that DeFi tokens are now reaping the benefits of the most recent upgrade to the platform.